Traders have become increasingly optimistic about the British pound according to Forex market data. Insights into how speculators are trading Forex from the US Commodity Futures Trading Commission last week showed the largest increase in bets on the GBP's rally since February 2020. Therefore, the gains from the GBP/USD's retracement continued to the resistance level at 1.3952, which is closer to testing the psychological peak of 1.4000, which confirms the bullish performance. This is due to optimistic expectations of a British economic recovery, given its impressive progress in vaccinations.

Commenting on the performance, Sean Osborne, Forex Strategist at Scotiabank, said: “The British pound saw its biggest bullish bet weekly with an increase of $1 billion, which raised the pound's net buying to its highest level since February 2020.” The reorganization of investor sentiment towards the British currency comes amid a period of outperformance by the pound, which has risen against all of its major counterparts so far in 2020.

Jane Foley, Chief Forex Strategist at Rabobank, says: “The net longs of the British pound rose higher. Investors hope that the UK's relatively rapid vaccine launch program will support the economy's recovery this year. The net purchase of the pound is now $1.824 billion."

"The British pound hit a new nine-month high against the euro and a new best in 34 months against the dollar at the start of the new week, driven by a rise in global stock markets and expectations that the British economy was on the cusp of a strong phase,” says Francesco Bisol, Forex strategist at ING Bank NV.

Analysts say the big shift in sentiment towards the pound has a lot to do with the Bank of England, which on February 4 effectively indicated that negative interest rates would not be introduced in the UK in 2021, leading to a major revaluation of the pound's assets and the UK's financial market. In general, the markets prefer the British currency amid a drop in negative interest bets from the Bank of England and the rapid rate of vaccinations in the UK.

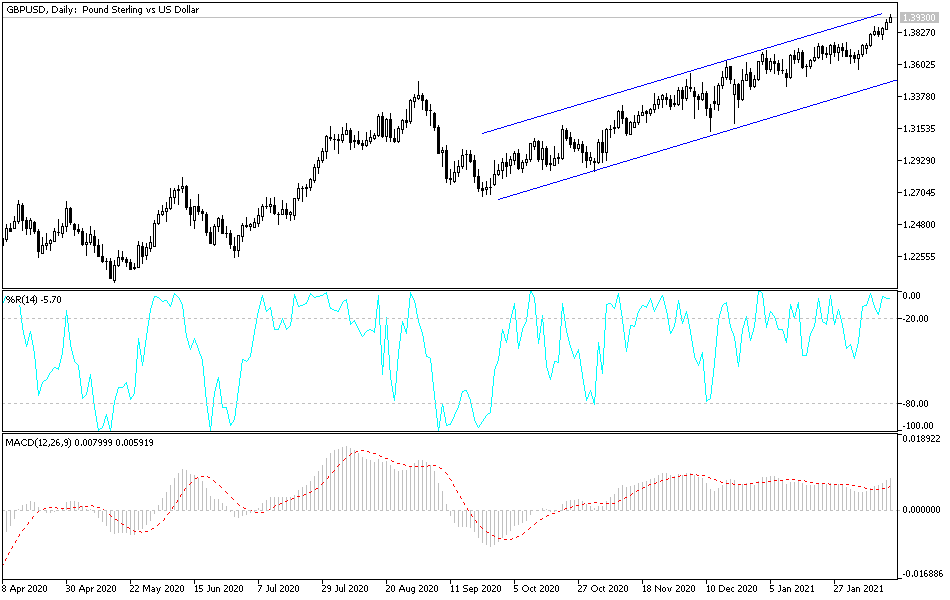

Technical analysis of the pair:

The recent strong gains of the GBP/USD pushed the technical indicators into overbought areas, and profit-taking sales are expected to occur at the resistance levels of 1.3955, 1.4020 and 1.4100. On the downside, a trend reversal can begin if the pair moves below the support level of 1.3755, according to the performance on the daily chart.

For the second day in a row, the economic calendar is devoid of any important US or British economic data, so the currency pair will continue to be affected by the extent of investor risk appetite and the movement of global stock markets.