The strong bullish momentum of the GBP/USD pair continues as it tested the 1.3865 resistance, its highest since April 2018, and settled near it as of this writing. Britain's advanced position in its vaccination rollout continues to support the pound, as rapid vaccination and containment mean a rapid recovery of the economy compared to other global economies. In addition, the Bank of England sparked a new push to buy the pound sterling on February 4th, when it actually indicated that negative interest rates in the UK are highly unlikely in 2021 unless there is a noticeable and unexpected deterioration in the course of the epidemic and the economy.

In addition, the bank says it is likely that there will be a strong economic recovery once the economy opens and people start spending the money they saved during the lockdown. Commenting on this, Robson, head of foreign exchange G10 strategy at NatWest Markets, says: “It appears that the Bank of England has ruled out the use of negative interest rates in the short period as additional easing could have been justified. This is very positive for the British pound, and we remain long against the euro and the Swiss franc. With the downside risks to the British pound at an all-time high rate, we see room for more sterling strength in the near term amid a faster vaccine rollout. The successful rollout should also mean that the BoE is not taking negative interest rates. This could support the British pound as well.”

Ruth Gregory, a senior UK economist at Capital Economics, said: “The recovery from the COVID-19 pandemic will be faster and more complete than most forecasters predict, suggesting that the economic legacy of the crisis may not be a permanently smaller economy, but rather higher inflation and a greater public deficit.”

But Ross Walker, an economist at the Royal Bank of Scotland, said in a research note in November 2020 that Brexit was likely to continue for a long time as a gradual, long-term obstacle to UK productivity and economic growth as a result of reduced investment and labor constraints. “Trade deals with non-EU countries will bring a dose of reality - far from regaining control, the UK will take whatever it can get from its larger trading counterparts who are less in need of a quick bargain."

NatWest Markets forecasts the GBP/EUR exchange rate at 1.14 by the end of March 2021, before falling back to 1.12 by the middle of the year and 1.11 by the end of the year. The exchange rate from the GBP/CHF is expected to be at 1.2610 by the end of March 2021, 1.247 by midyear, and 1.222 by the end of the year.

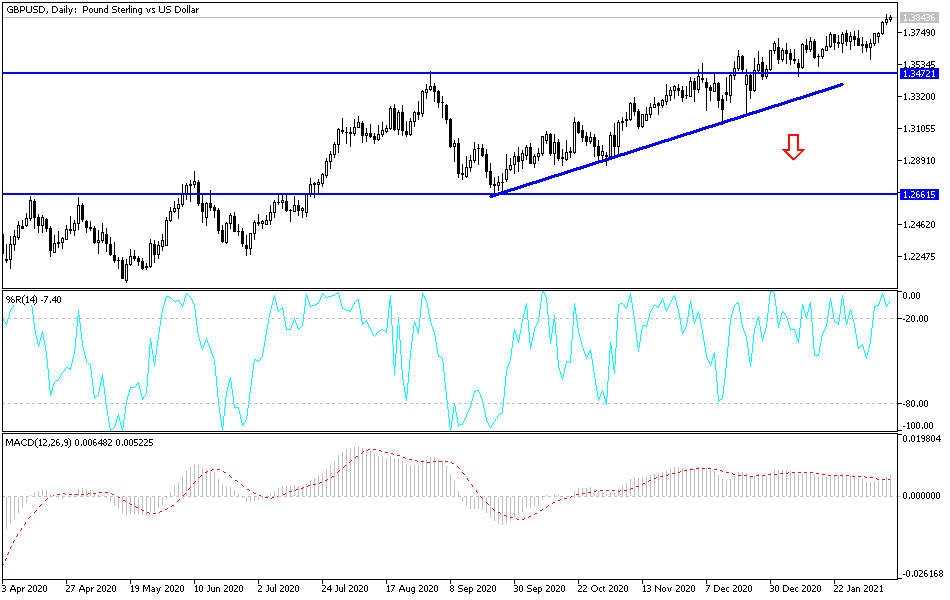

Technical analysis of the pair:

According to the performance on the daily chart, the GBP/USD currency pair is in the range of a sharp bullish channel, and the recent gains may push for a move towards the psychological resistance of 1.4000 as soon as possible. At the same time, it must be taken into account that the technical indicators have reached strong overbought areas, and therefore, sudden profit-taking operations are not being ruled out. On the downside, the closest support levels for the pair are currently 1.3770, 1.3690 and 1.3580. The UK's coronavirus vaccination trajectory and US stimulus plans should be watched to anticipate the next move in the currency pair. Today the pair will be affected by the weekly US jobless claims announcement.