At the beginning of this week's trading, bulls tried to stabilize the GBP/USD close to the previous week's gains, around the 1.3758 resistance level. However, risk aversion supported the dollar's gains, and thus the pair retreated to the 1.3656 support level at the beginning of Tuesday's trading. The pound’s movements in the Forex market this week will be dependent on what the Bank of England will decide regarding interest rates, and there will be an opportunity to give up many of the gains that contributed to crowning the sterling as the best currency since the beginning of this year. Until the bank’s decision, analysts expect the pound sterling to trade on the basis of a mixture of global financial market sentiment and the positivity surrounding the vaccination program in the United Kingdom.

"The British pound could suffer if the Bank of England unexpectedly cuts interest rates by 10 basis points to zero this week," said Robert Howard, a market analyst for Reuters. The pound is trying to meet the dollar's recovery, relying on some expectations from a team of economists that the Bank of England will keep interest rates at 0.10%, leaving quantitative easing levels unchanged.

54 out of 57 economists polled by Reuters earlier this month predicted that the Bank of England would leave interest rates at 0.1% at their February 4th meeting.

“We do not expect any changes in monetary policy from the Bank of England this week, but we are looking to end the negative review of interest rates by reducing the minimum to -50 basis points,” said Robert Wood, a British economist at Bank of America. "We have lowered our estimate of potential growth to 0.4% year-on-year. ”

However, a sudden change in these rates could cause the sterling's price to drop sharply.

Even if the BoE does not choose to change the rates, its message about the future of interest rates can be just as important. The basic rule for trading here is that the sign of a rate cut in the coming months is negative for the British pound. Therefore, if the market leads to negative interest rate expectations as a result, the British pound may fall against the rest of the other major currencies.

Derek Halbene, Head of Research at MUFG, said: “The British pound is once again more connected to the performance of global stock markets this month, which may reflect the dwindling effect of Brexit risks. The pound's sensitivity towards the dollar, yen and franc was a reminder that investor sentiment towards risk against these currencies is important. When the markets rise, the pound tends to rise, but it falls when the markets reverse."

More recently, concerns created by swarms of retailers targeting the severely shorted stocks to clear hedge funds' short positions' have recently shaken markets' sentiment and serve as a reminder that markets cannot be expected to rise indefinitely. Therefore, the rise in GameStop share prices represents a new phenomenon in the stock market, where the stock rose sharply, and thus dealt a severe blow to institutional investors and hedge funds that were betting against stocks.

This suspicion was confirmed by Goldman Sachs data released over the weekend which showed that hedge funds are shifting large sums of money out of stock markets at the fastest pace since 2014.

Britain maintains a higher vaccination rate than in the other G10 countries, which could allow the UK's economy to open up sooner than anywhere else. This may provide sufficient support for the British pound in the coming days and weeks. “We expect the UK vaccination advantage to continue pushing the EUR/GBP down for the rest of 2021,” says Francesco Bisol, Forex Strategist at ING.

Johnson & Johnson-owned pharmaceutical company Janssen announced on Friday that its single-dose candidate has demonstrated high efficacy, and that approval applications will now begin. The UK has requested 30 million doses of the vaccine, which have been provided on a non-profit basis, and a consultant to the UK Vaccine Task Force says it could be approved and launched in February.

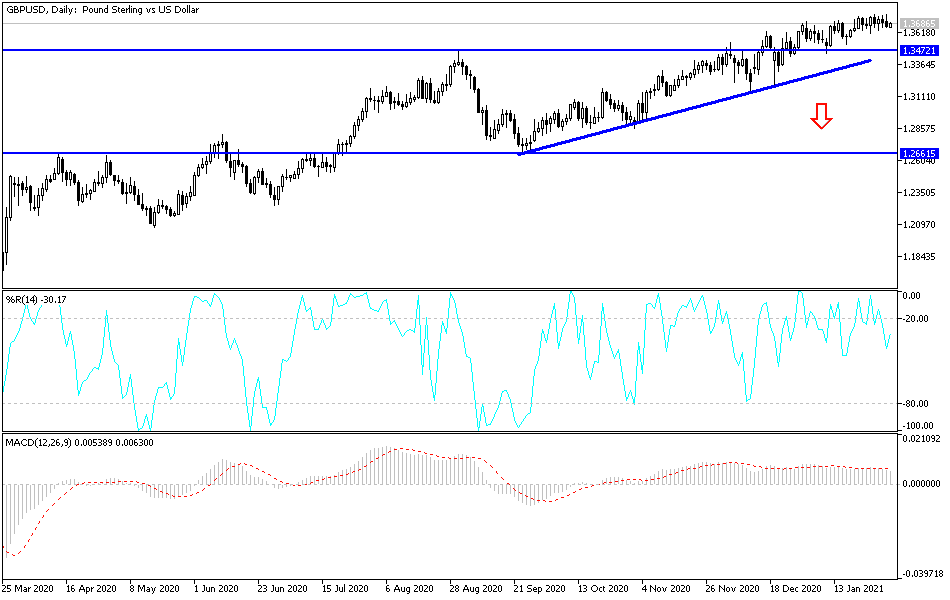

Technical analysis of the pair:

Despite the strength of the US dollar, the bullish stability of the GBP/USD is still strong, as the factors for the strength of the pound still exist and may remain so until the final announcement of the decisions of the Bank of England this week. Stability around and above the resistance at 1.3700 increases the bulls' control, and the stronger gains from it, as I mentioned before, will push the technical indicators to strong oversold areas. With the pound's momentum slowing, it may be subject to take-profit sales from the resistance levels at 1.3765, 1.3825 and 1.3900. On the downside, the general reversal of the trend will be conditional on the move towards the support level at 1.3435.

Today the currency pair does not expect any important economic data from Britain or the United States of America.