The Forex market today is waiting for the Bank of England's decision, which will set the path of the British pound against other major currencies in the near future. The GBP/USD pair is preparing for today's decision by settling around the 1.3600 support level as of this writing. According to the European Bank Société Générale, the Bank of England will cut the benchmark interest rate and raise the quantitative easing program to support the British economy that has been ravaged by the lockdown. Société Générale says a lot has changed since the bank’s economists released their latest set of forecasts in November. With a tight lockdown imposed in January, the economy's outlook materialized for the worse.

As such, policymakers will act by increasing the incentives they provide to the faltering economy. Therefore, this step is likely to surprise the market, as the general opinion is that the bank is ready to keep interest rates unchanged and to consider the current difficulties facing the economy, and choose to focus on the spring recovery in activity.

Thus, the cut is likely to lead to market error and undermine the rise in the pound, which could lead to a sharp reversal in value. Brian Hilliard, economist at Societe Generale says: “Since the last meeting of the Monetary Policy Committee for the monetary policy report in November of last year, the fight against coronavirus has many new challenges that have damaged the economic outlook in the short term. The emergence of new variables and the alarming increase in the level of injuries, hospitalizations, and deaths have put the National Health Service under increasing and increasing pressure."

The Bank of England's meeting is coinciding with the bank's quarterly inflation report, as new forecasts are released. Usually in these high-level meetings, the bank chooses to make changes to interest rates and quantitative easing, which means that the February report will receive more interest from the markets than usual. Members of the Bank's MPR in November took into account the November 2020 close, but Hilliard says this report was very optimistic about the closing level necessary in the first quarter of 2021.

"The result is that the MPC is likely to drastically cut its GDP forecast for this year from the current 7% to closer to 5%," Hilliard says. Consequently, the Société Générale expects the MPC to ease policy again in February and announce a boost to the existing quantitative easing program by £150 billion. But Thursday's event for the MPC will also see the bank's report back on the findings of a review of whether negative interest rates will be possible in the UK.

Accordingly, the bank's prudential regulatory authority began reviewing the matter last October, and its results are likely to determine whether a reduction to 0% or less is possible without negatively affecting the country's financial services sector. In this regard and in a speech in January, Monetary Policy Committee Member Sylvana Tenryu said that she believes negative interest rates will be a positive development that could help the British economy under pressure. However, other members of the MPC, including BoE Governor Andrew Bailey, said in January that it was too early to consider lowering interest rates, even if it was an option worth considering in the coming months.

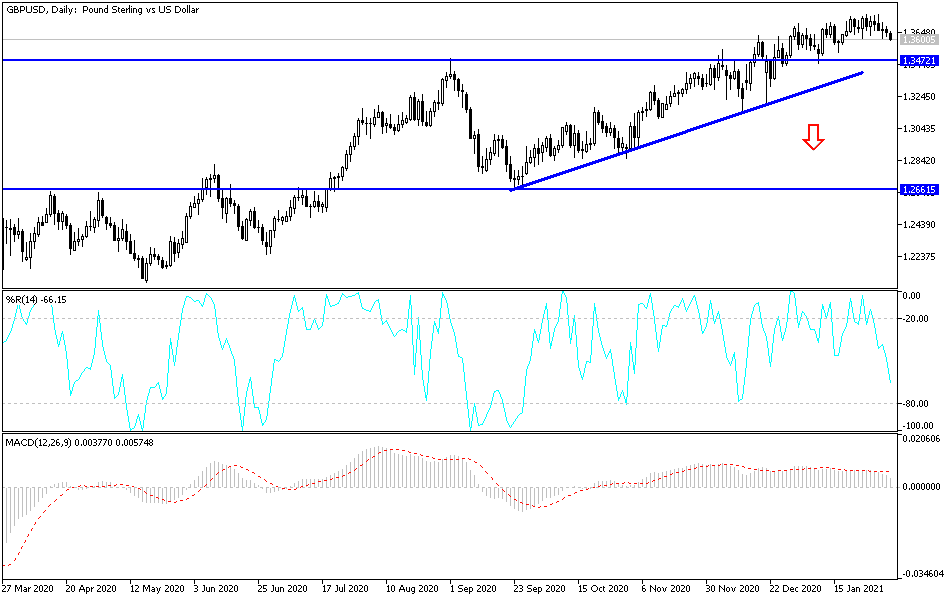

Technical analysis of the pair:

The performance of the GBP/USD on the daily chart indicates that a bearish performance is beginning, and a bearish trend reversal may occur if the pair moves quickly to support levels at 1.3575 and 1.3440. The Bank of England's decisions today may benefit the pair, as bulls may return strongly and stability above the 1.3700 resistance is important for the pair to continue to rise. Whatever the day’s decisions, I still prefer to buy the currency pair from every downward level, as Britain’s position in the world’s struggle to vaccinate against the coronavirus qualifies the pound to achieve more in the coming days.

Today's economic calendar:

For the GBP, there will be the British PMI reading for construction, followed by the Bank of England’s decision on interest rates and the asset purchase plan. For the USD, weekly jobless claims, non-agricultural productivity and US factory orders will be announced.