Bearish signal

Sell the GBP/USD ahead of the BOE decision.

Add a take-profit at 1.3550 and a stop loss at 1.3682.

Bullish signal

Place a buy stop at 1.3682 and a take-profit at 1.3750.

Set a stop-loss at 1.3550.

The GBP/USD price is under pressure ahead of the first Bank of England (BOE) interest rate decision of the year. It has declined for the past two consecutive days and is trading at 1.3612, which is the lowest level since January 26.

Bank of England Decision

The BoE started its interest rate decision yesterday and will deliver its decision in the afternoon session today. Economists expect that the bank will sound a bit dovish today as the UK economy goes through its worst contraction in decades.

In general, the bank will leave the headline interest rate unchanged. It will also leave the ceiling of quantitative easing intact at about 875 billion pounds. Further, the bank will commit to continue using all its available tools to support the economy.

Still, the GBP/USD will move because of any hints of negative interest rates. In January, a member of the monetary policy committee talked favourably of negative rates citing their “effectiveness” in Japan and Switzerland. However, Andrew Bailey warned of the complexities of implementing them in the UK.

The BoE decision will come a day after we received relatively weak Service PMI data from the UK. According to Markit, the Service PMI declined to 39.5 in January, the lowest reading since April last year. This happened because of the third national lockdown implemented by the Boris Johnson administration.

In addition to the BoE decision, the GBP/USD will also react to economic data from the United States. Yesterday, data by the ISM showed that the Service PMI rose from 57.7 in December to 58.7 in January. The Markit figure came in at 58.3.

Further data by ADP showed that US private companies hired more than 174,000 people in January. That was an improvement from the previous month’s job losses. Traders will also look ahead to the nonfarm payroll numbers scheduled for tomorrow.

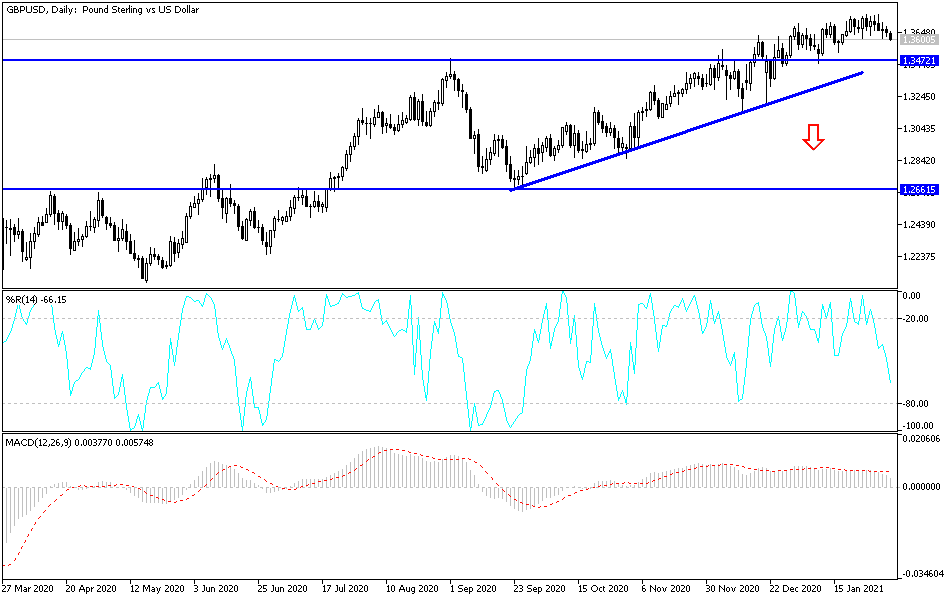

GBP/USD Technical Outlook

Early this week, the GBP/USD price moved below the important support level at 1.3636 where it had struggled to move below last week. It then moved back up and reached the resistance level at 1.3682. In the past two days, bears have prevailed and the pair seems to be on the verge of a major bearish breakout. The 15-day and 25-day exponential moving averages (EMA) have made a bearish crossover also. Therefore, the pair will likely continue dropping, with the next level to watch being 1.3550.