Bearish View

Sell the GBP/USD and set a take-profit at 1.3800 (38.2% Fib).

Add a stop-loss at 1.3920.

Timeline: 1-3 days.

Bullish View

Set a buy stop at 1.3920 (Monday high).

Add a take-profit at 1.3970 (above yesterday’s high).

Set a stop-loss at 1.3865.

The GBP/USD pulled-back slightly yesterday after the sudden upswing in the US dollar. The pair will today react to the important UK inflation, US retail sales numbers, and the talks on stimulus.

UK Inflation Numbers

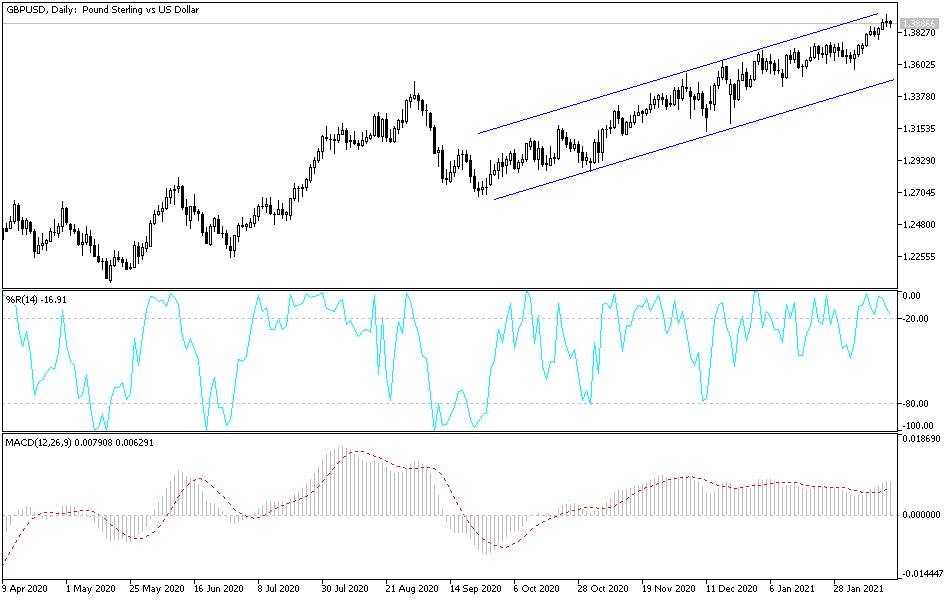

The GBP/USD has been rallying recently because of renewed hopes that the UK economy will recover. The country has already reached a Brexit deal with the European Union and the central bank has avoided negative interest rates. Also, the UK has already administered vaccinations to more than 15 million people.

Today, the Office of National Statistics (ONS) will publish the latest inflation numbers from the country. Economists polled by Reuters expect the data to show that the headline Consumer Price Index (CPI) rose by annualized rate of 0.6% in January. They also see the core CPI rising by 1.3%. The two are still below the Bank of England’s target of 2.0%.

Meanwhile, the ONS will also publish the latest Retail Price Index (RPI) and Producer Price Index (PPI). The estimates are for the RPI to rise by 1.3% while the PPI input and output rose by less than 0.6%.

Strong UK inflation numbers will incentivize more traders to buy the British pound. This is because it will increase the possibility of future rate hikes, not cuts, by the Bank of England.

The GBP/USD also retreated after the continued rise of US treasuries. The ten-year and the 5-year yields have been rising as traders bet on higher US inflation. A high inflation rate will lead to faster rate hikes by the Fed.

The pair will also react to the US retail sales numbers that will come out in the afternoon session. Also, it will react to the important minutes of the recent Federal Reserve meeting. In it, the bank left interest rates unchanged and pledged to leave them there until the economy improved.

GBP/USD Technical Outlook

The GBP/USD dropped from the year-to-date high of 1.3951 to a low of 1.3860. On the hourly chart, this price is along the 23.6% Fibonacci retracement level. It was also at the same level as the highest level on February 10. The pair has also moved below the 15-period and 25-period moving averages. Therefore, while the overall uptrend remains, the pair may continue falling as bears target the 38.2% retracement at 1.3800.