Bullish Case

Buy the GBP/USD and set a take-profit at 1.4050.

Add a stop-loss at 1.3772 (Friday’s low).

Bearish Case

Set a sell-stop trade at 1.3772.

Add a take-profit at 1.3700 and a take-profit at 1.3850.

The GBP/USD price rose to the highest level in more than 34 weeks mostly because of the relatively weak US dollar and the ongoing vaccination efforts in the UK. The pair is trading at 1.3950, which is 22% above last year’s low of 1.1407.

British Pound Rally Continues

The GBP/USD is rising as investors react to the rising optimism on the ongoing UK vaccination efforts. The recent data shows that more than 15 million people have already received a vaccination, two months after the initial rollout.

If the progress continues, it means that most of the country’s population will be vaccinated in the next few months. As a result, this will lead to more business activity in the country, which will possibly support the economy.

Most importantly, signs of recovery will remove the incentive for the Bank of England (BOE) to implement negative rates. In its most recent decision, the bank said that it was still studying the impacts of such rates.

The GBP/USD is also rallying ahead of key economic numbers from the UK. Tomorrow, the Office of National Statistics (ONS) will publish the important inflation numbers. Economists expect the data to show that the headline Consumer Price Index (CPI) rose by just 0.5% in January while the core CPI rose 1.3%. The ONS will also publish the Producer Price Index (PPI) data. On Friday, the agency will publish the latest UK retail sales and the public debt data.

The pair is also rising because of the weak US dollar. The currency has weakened against most developed and emerging market currencies as Congress starts piecing together the new $1.9 trillion stimulus package.

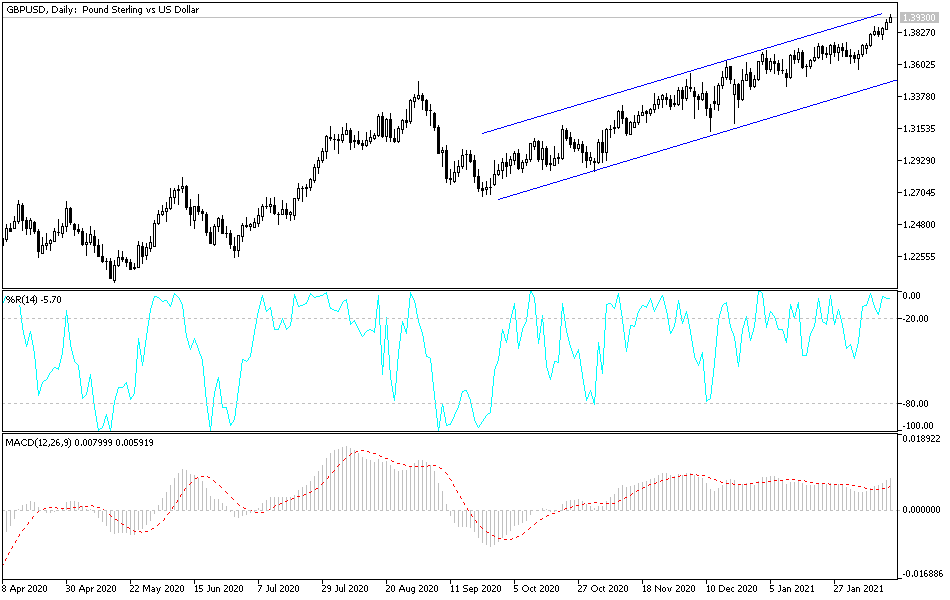

GBP/USD Technical Outlook

The GBP/USD price is on the third consecutive day of gains today. On the daily chart, the pair has formed an ascending channel. The current price is a just a few pips below the upper side of this channel. It has also moved above the Ichimoku cloud and all moving averages. Therefore, the pair will likely continue rising as bulls target the upper side of the channel. To do that, bulls will need to move above the important resistance at 1.4000.