Bearish View

Set a sell stop at 1.4130 (lower side of the flag).

Add a take profit at 1.4083 (yesterday’s low).

Set a stop loss at 1.4165.

Bullish View

Set a buy stop at 1.4160 and a take-profit at 1.4200.

Add a stop loss at 1.4100.

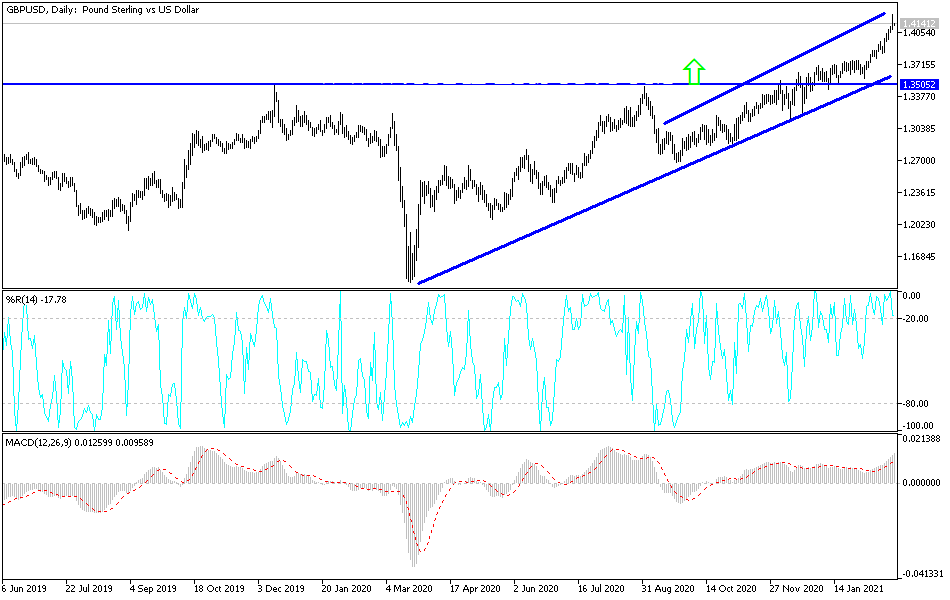

The GBP/USD price retreated yesterday after hitting its highest level since March 2018. The pair is trading at 1.4140, which is 0.72% below the highest point yesterday.

British Pound Retreats

The GBP/USD has been in high spirits in the past few months. The pair has risen by 24% from last year’s low of 1.1415. This makes sterling one of the best performing G7 currencies since March last year.

The Bank of England (BOE) is a key reason why the pair has done well. In past meetings, the bank has resisted pushing its interest rates to the negative zone. Recently, the bank said that subzero rates would have a negative impact on the banking sector, which is a major employer.

The weak US dollar, progress on Brexit, and the government’s response to the pandemic have pushed more traders to embrace the currency.

There will be no economic release from the UK today. Therefore, the focus will be on the United States, where the statistics agency will publish the second reading of the fourth-quarter GDP data. The agency will also release the latest durable goods orders and the latest jobless claims numbers.

Economists believe that the GDP data will not have a significant change from what the agency released last month. This means that the economy probably increased by 4.0% in the fourth quarter helped by the relatively strong private consumption. Later on, the National Association of Realtors will deliver the latest pending home sales numbers.

The GBP/USD will also react to the latest news about the stimulus. Democrats are still debating Joe Biden’s $1.9 trillion stimulus package that will push the total US debt to almost $30 trillion.

GBP/USD Technical Outlook

The GBPUSD pair dropped yesterday as some bulls started taking profit. The pair is trading at 1.4140, which is lower than this week’s high.

The hourly chart shows that the pair dropped to a low of 1.4083 yesterday and has been attempting to recover. The pair also seems to be forming a bearish flag pattern and is slightly above the 25-day exponential moving average.

Therefore, in the near term, the pair may break-out lower because of the flag pattern. If this happens, the next key level to watch will be yesterday’s low of 1.4080. However, there is a possibility that buyers will come back as they attempt to buy the dip.