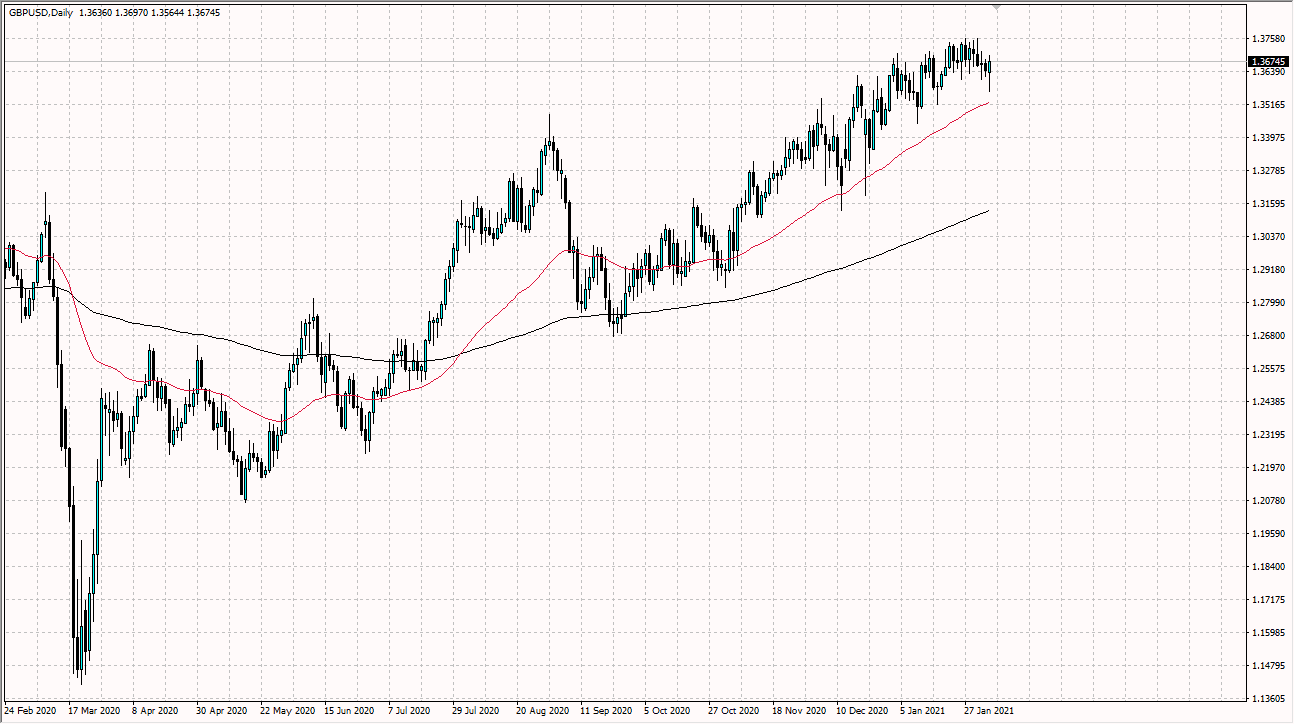

The British pound initially fell during the trading session on Thursday in anticipation of the Bank of England interest rate decision and rate statement. The bank has made it abundantly clear that they are not approaching negative interest rates, something that perhaps the trading population started to believe. As a result, the British pound turned around and recover quite nicely to break above the 1.37 level. Since then, we have broken back down a little bit, but now it simply looks like a continuation of the back and fill type of trading that we have been seeing for some time.

The 50 day EMA underneath sits near the 1.35 level underneath, and as a result the market continues to see the 50 day EMA race towards current prices. The 1.3750 level above is significant resistance, so if we were to break above there it would be a very bullish sign for the British pound and would almost certainly send the market towards 1.40 level above. This is a market that I think will continue to see volatility, which of course makes quite a bit of sense due to the fact that although the British pound is historically cheap, the reality is that there are a lot of mixed messages going around right now.

The United Kingdom has been locked down for some time, and of course the economy is struggling as a result. However, a lot of trading is being done due to vaccinations, and it seems that the United Kingdom is leading the race in a lot of ways. This is a market that is probably going to go much higher. This does not mean that has to happen right now, so I think we will get the occasional pullback like we have seen during the day on Thursday. Nonetheless, the 50 day EMA has been extraordinarily reliable recently as support and I do not see that changing in the short term. If it did, then the market may have to unwind down towards the 1.3250 level. At that point, the market would go looking towards the 200 day EMA which is probably going to try to meet up in that general vicinity. Keep in mind that Friday is Non-Farm Payroll, so obviously the US dollar will be jumping around.