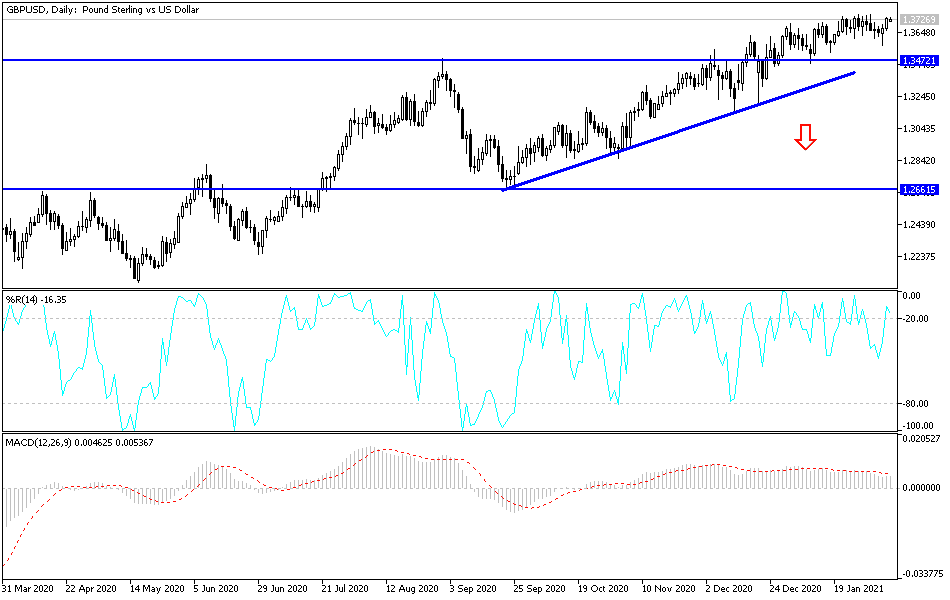

The British pound rallied during the trading session on Friday as the jobs number was lackluster to say the least. By doing so, the market then slammed into the region that is the 1.3750 handle. This is an area that has been rather resistive as of late, and certainly seems to be the prize that the bullish traders are trying to take out. If we can get above that level, then it is very likely that we go looking towards 1.40 level initially, perhaps even followed by the 1.42 area based upon the weekly chart.

To the downside, you can still see that we have an ascending channel, as well as the 50-day EMA. In other words, there are plenty of reasons to think that this market could go higher, and that pullbacks should be buying opportunities. After all, the United Kingdom has rolled out the vaccine better than most others, and is way ahead of many others when it comes to vaccinations. That is a very important factor when trying to price the currency itself. Granted, the United Kingdom has seen a massive lockdown, and that certainly would hurt the idea of a strong economic growth cycle. However, we are at historically cheap levels, despite the fact that the British pound has essentially been on fire over the last six months.

I believe that going forward, dips will continue to be buying opportunities, especially if we get closer to the 1.36 handle or even the uptrend line/50-day EMA combination that we see underneath. Currently, I see the market as trading between the 1.35 level on the bottom, with the 1.3750 level on the top. Once we break out of that range, then you can extrapolate for a bigger move; but currently, it looks as if the buyers are more than likely going to win this argument. On a daily break above the 1.3750 level, I would be going long, and perhaps even aggressively so, as this could be a major breakout just waiting to happen. After all, when you look at the last couple of weeks, we have most certainly seen this level defended quite aggressively. There have been at least six or seven attempts recently, so this is one of those areas that might “mean something” if it breaks.