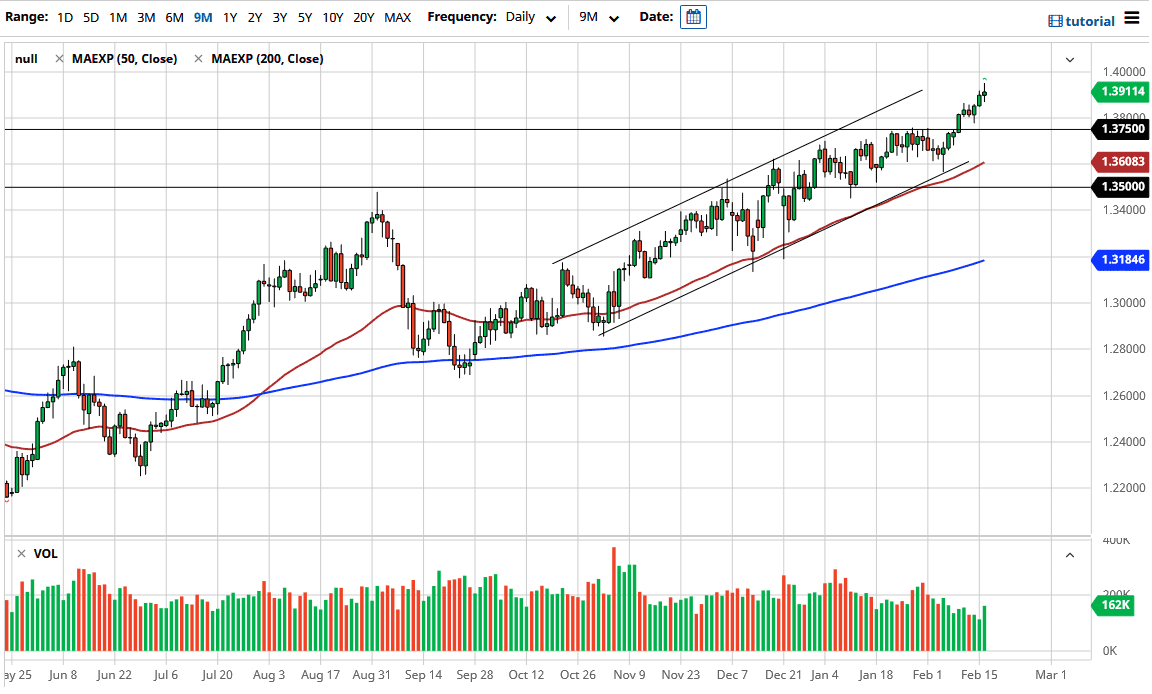

The British pound rallied initially during the trading session on Tuesday but pulled back from the area just above the 1.39 handle. By the end of the day, we ended up forming a bit of a shooting star-type of candlestick, so it looks as if we could get a bit of a pullback. The fact that the market is pulling back should not be a huge surprise, because it that had gotten far ahead of itself. We recently had broken above the 1.3750 level and shot straight up in the air. We have not had a retest of the breakout, so we could see a pullback all the way back down to that level.

Longer term, I do believe that we are going to go looking towards the 1.40 level, which is a large, round, psychologically significant figure, as it is not only an obvious place from a numerical standpoint, but it is also an area that we have seen interest in the market more than once in the past. I think the real resistance is probably closer to the 1.42 handle, and I look at this market as bouncing around between the 1.3750 level and the 1.42 level over the next several weeks.

Keep in mind that the British pound is rallying due to the fact that there seems to be an acknowledgment of the inoculation program that has been going on in the United Kingdom, and the fact that they are well ahead of many of their G-10 peers. Furthermore, we have gotten past Brexit, or at least the majority of it, and there is still a bit of a relief rally ahead of us, as the market has been suppressed due to the uncertainty when it comes to that situation.

To the downside, even if we were to break down below the 1.3750 level, I think that the 50-day EMA could come back into play, just as the uptrend line from the channel could be supportive as well. In other words, I think that this is a market that continues to find value hunters on dips, so even if we do pull back, I am more than willing to simply wait for signs of support to take advantage of them.