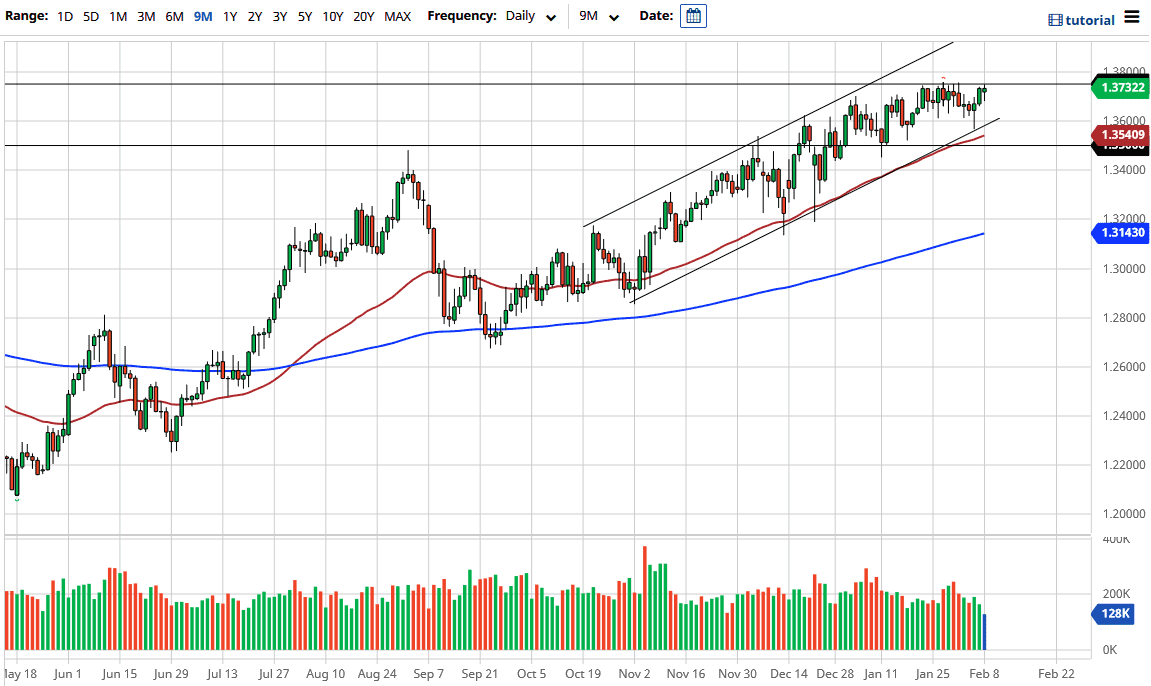

The British pound pulled back a bit during the trading session on Monday but has turned around to show signs of strength yet again. If we can break above the 1.3750 level, it is likely that the market could go looking towards the 1.40 level after that. The market looks very likely to look at pullbacks as buying opportunities, because every time we do pull back the market jumps right back in to push the pound higher. Looking at the chart, it is obvious that the 1.3750 level being broken to the upside would be a huge sign of continued strength, and I think at that point we will see a significant amount of momentum pick up.

Looking at the candlestick for the day, if we were to break down below the candlestick from the Monday session, then it could open up a move down towards the 1.36 level underneath. That is an area that has been supportive previously, and also features an uptrend line just below there as well. The market is likely to continue to see buyers jumping in based not only upon the uptrend line, but also the 50-day EMA which sits underneath.

If we do get that breakout, I think that the 1.40 level is a massive barrier that will probably attract a lot of resistance. There will be a line of profit-taking in that general vicinity, and I think that a pullback from there should send this market looking for value underneath that people will take advantage of as well. If we do break above the 1.40 level, the British pound could go much higher, reaching towards the 1.50 level over the longer term, which is a significant level that people will be paying attention to. I think that is a longer-term target, assuming that the US dollar does in fact get sold off. Recently, we have seen a lot of tenacity and the idea that the reflation trade will work against the greenback, as the US is going to pass $1.2 trillion in stimulus. The ‘reflation trade’ will be one of the main things working against the USD, so I suspect a breakout is only a matter of time at this point.