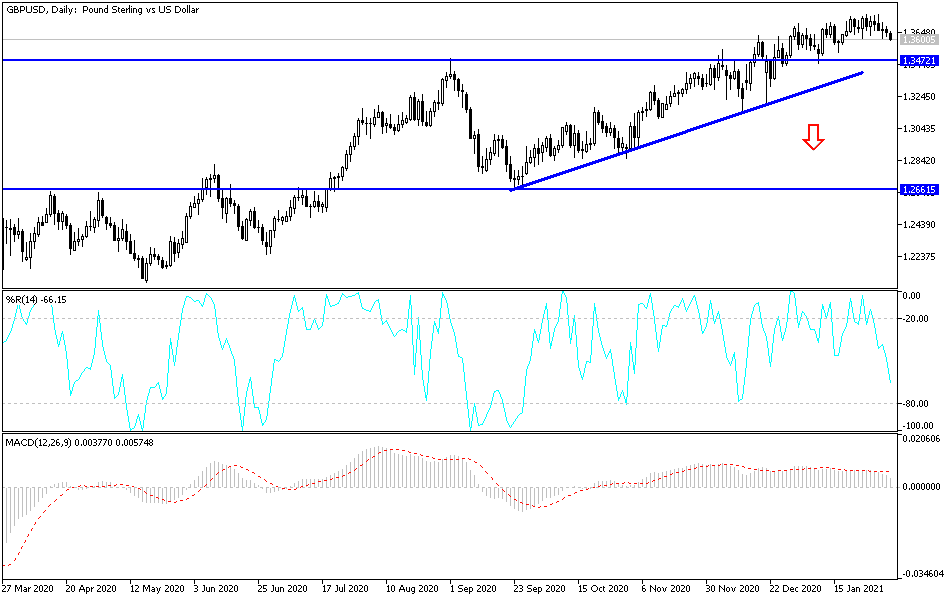

The British pound pulled back ever so slightly against the US dollar during the trading session on Wednesday, as it looks like we are trying to reach towards the bottom of the bullish channel that I have drawn on the chart. Further backing up the idea of the channel being supportive is the fact that the 50-day EMA is following the bottom uptrend line, so it certainly looks like we continue to find reasons to start buying. Nonetheless, we have pulled back just a bit from the crucial 1.3750 level, an area that has caused multiple resistance wicks above. However, it looks as if the market is trying everything it can to break up and out of there.

To the downside, even if we broke through the channel, the market probably finds significant support near the 1.3250 level, so I think that it might be a short-term selling opportunity at best. Keep in mind that the British pound is still historically cheap, and although the British economy is going to struggle going forward, one of the things that has lifted the British pound lately is the fact that the Bank of England has made it fairly clear that negative interest rates are off the table. If that is the case, then it does alleviate some of the pressure on sterling, at least from the most bearish of traders.

The question now is what happens with the US dollar? In fact, that is probably the most important component of this currency pair, as the US dollar is seemingly at a crossroads. We had seen the US dollar sell off drastically against almost anything and everything around the world, but now it is getting close to an area that should be massive support from a longer-term structural standpoint. If that is the case, then it will be interesting to see how this plays out over the next several weeks. Keep an eye on the US Dollar Index, because it has bounced nicely over the last several days from an extreme low. In fact, there is a bit of a “bottom” in the US Dollar Index near the 88 handle that I think needs to get broken for currencies such as the British pound to rip to the upside. Currently, we are still correcting the selling pressure in the US dollar, so it adds up that we would probably continue to pull back just a little over here.