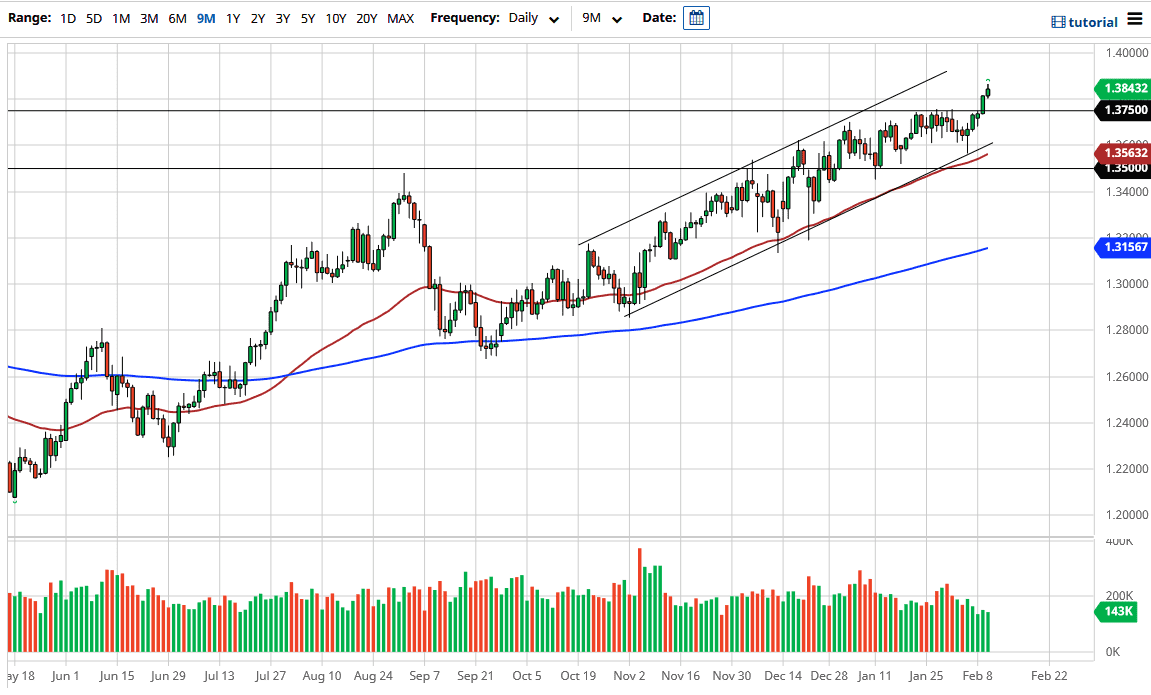

The British pound continues to look very bullish, continuing the gains that we had seen during the previous session. This is a market that will attract a certain amount of buyers jumping back into the marketplace based upon the fact that we have just broken out of a major resistance barrier in the form of the 1.3750 level. At this point, I would anticipate that the British pound goes looking towards the 1.40 level longer term, but we may get a short-term pullback in order to offer enough momentum to the trade.

What is worth noting is that it took several weeks to break above the 1.3750 level, so the breakout does mean something for a bigger move. I have no interest in shorting the British pound because we have seen the market show so much strength, and I think we are much more likely to reach 1.40 then we are to reach back down towards the 1.36 level.

The British pound is getting a bit of a boost due to the fact that we have seen the UK lock down the economy and “bend the curve” much better than a lot of the other economies around the world. Beyond that, we also have the reality that Brexit is basically in the rearview mirror, and the “return to normalcy” in the United Kingdom should probably send this market much higher as there will be a lot of demand for the expansive growth that we will see in the UK.

A “buy on the dips” mentality is going to be the way this market behaves. Short-term charts might be the best to get into the market, as it offers value, and you can take advantage of the overall momentum. Given enough time, I believe that the British pound will not only reach the 1.40 level, but it is very possible that we may go looking towards the 1.50 level after that, which is a little bit closer to the historical norms that this market tends to trade. I think you can start to build a fairly large position with several small entries.This is a trade that will probably run for at least several weeks.