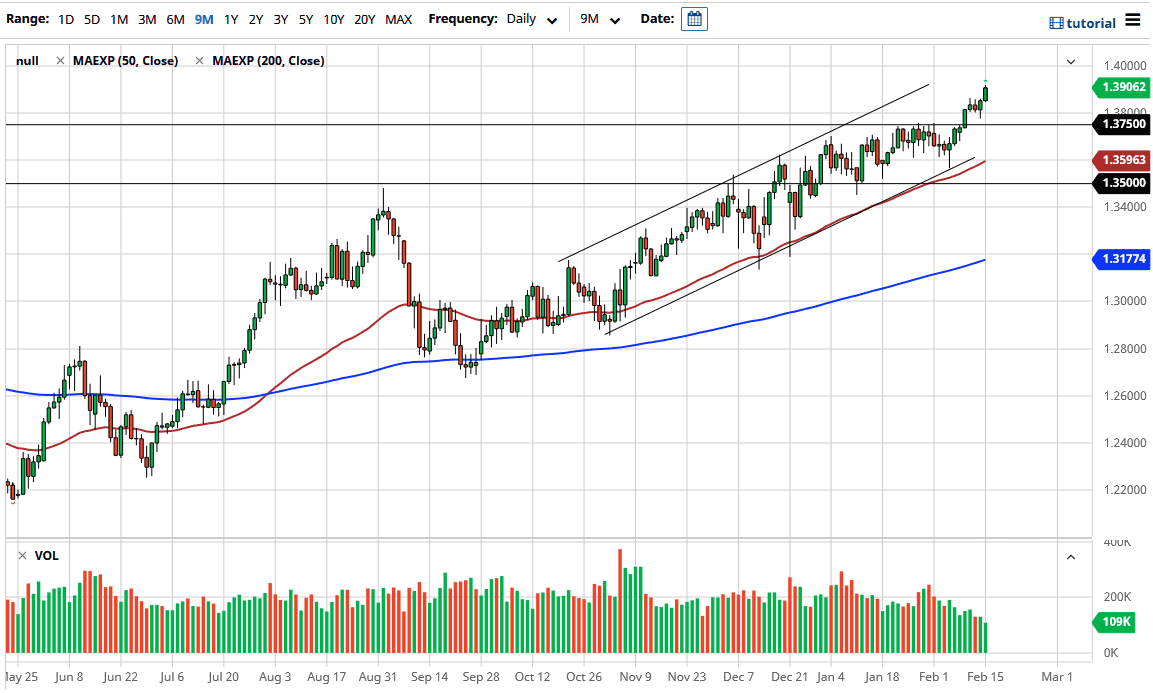

The British pound rallied again during the trading session on Monday, as traders pound into sterling. The 1.39 level has been broken above, and now it looks as if the market is going to go looking towards the 1.40 level. By breaking above the 1.3750 level, and then pulling back, the market has shown itself to be very resilient, and it looks as if we are ready to go towards the previously mentioned 1.40 level. Furthermore, when you look at the longer-term chart, you can make a serious argument for the market finally reaching the 1.42 handle, but I think that the 1.40 level itself will cause a bit of resistance as it is a large, round, psychologically significant figure.

To the downside, the 1.3750 level should be a “hard floor” in the market due to the fact that it was the scene of a major breakout. I think at this point we are very likely to see a lot of buyers jump in somewhere around that area. I would be especially aggressive on some type of supportive candlestick if we get a pullback to that area, but even then, I believe that we could be buyers on a break above the top of the candlestick from the session on Monday. After all, American traders were away as it was Presidents’ Day, so there is a certain amount of liquidity that was not even in the market.

The US dollar is been hammered due to the idea of stimulus, which could drive down the value of the greenback. This should continue to propel the British pound higher in general, so you can have no real designs on shorting anytime soon. In fact, I would need to see this market take out the 1.36 level to even begin contemplating it. I like buying dips, and I do think that it is only a matter of time before we not only reach 1.40, but 1.42 after that. The British pound has been moving on the idea of more coronavirus vaccinations in the UK, as they have passed the 14 million mark on the first round, which from a percentage standpoint is much better than most of its peers in the European Union and other G 10 countries.