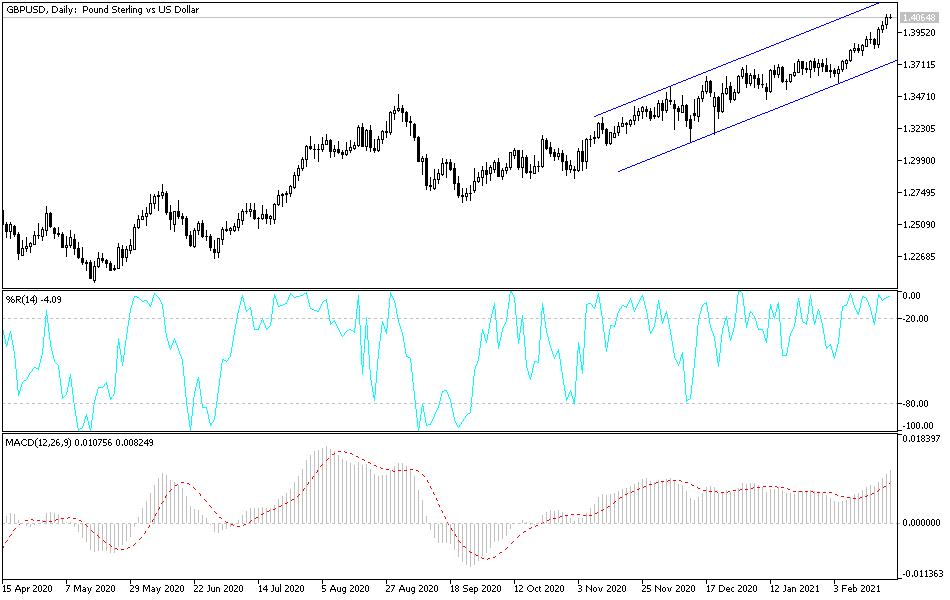

The British pound has rallied again during the trading session on Tuesday to reach the top of the uptrending channel. The 1.41 level is just another handle, and at this point I think we are eventually going to go looking towards 1.42 level. That is an area where we have seen a lot of selling pressure in the past, so it makes sense that we would go looking towards that area to retest it. I think we will probably pull back from there, but I am the first to admit that I thought a pullback would have happened by now anyway. This was especially true as we formed a shooting star at the 1.40 level. Unless you were a buyer of this market down on the breakout of the 1.3750 level and how long, this has been very difficult to get involved with.

This does not mean that you will get an opportunity to buy the British pound; quite contrary to belief, it will eventually pull back. Sometimes the hardest thing to do as a trader is to wait for a decent entry. We do not have one right now, and I certainly would not be a buyer all the way up at these levels with roughly 100 points of possible gains, while we would more than likely have to risk at the minimum 100 points. Realistically, we would probably have to set stop losses at about 300 points. In other words, there is no buying opportunity here. However, if you were already long of this market, there is absolutely nothing to do but wait until it hits the 1.42 level and see how it behaves.

The uptrend was further exacerbated by Jerome Powell suggesting that he was not worried about inflation in the United States, and therefore the US dollar sold off a bit. Sooner or later, higher interest rates could drive the value of the dollar higher, and we have certainly seen that in some other currency pairs, but we have yet to see that against the British pound as it is historically cheap at this point, and a lot of Forex traders are looking at the fact that the UK has given over 25% of its population the first dose of the vaccine.