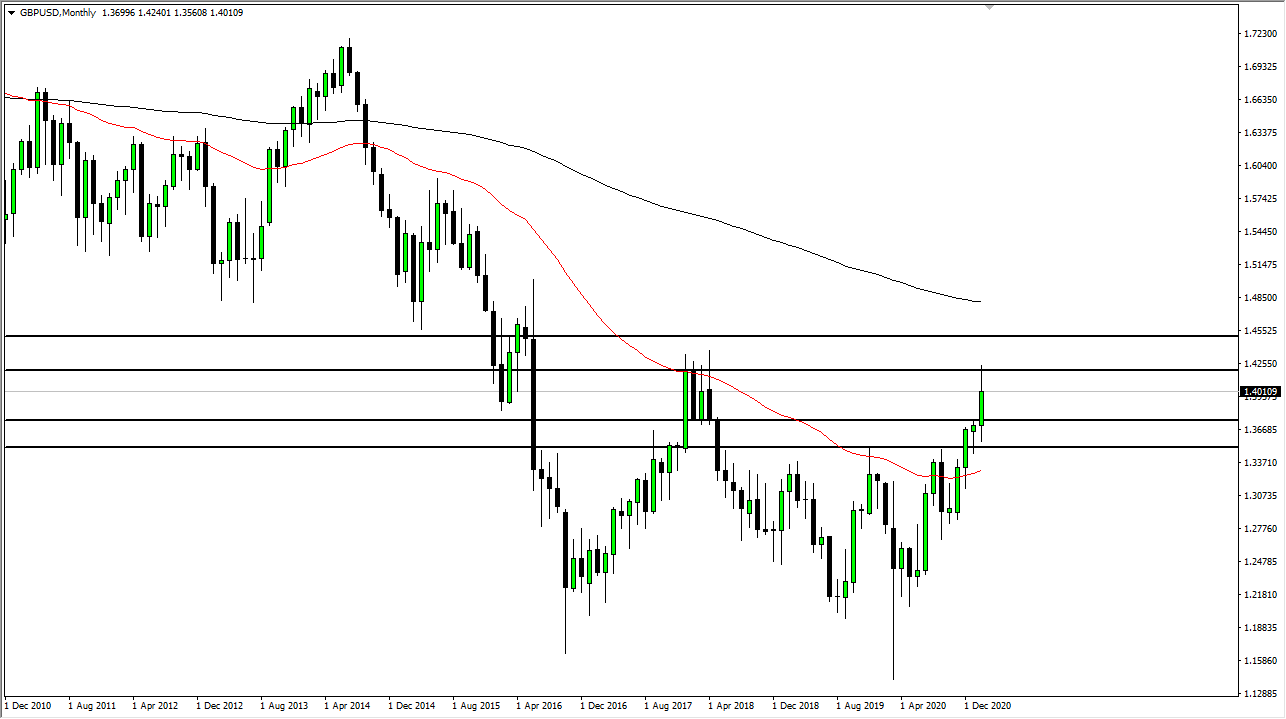

The British pound pulled back initially during the course of the month but then broke above the crucial 1.3750 level, an area that had been massive resistance previously. Now that we have broken through it, the British pound looks as if it is ready to continue to take off to the upside. In fact, we shot straight up to the 1.42 level right away but have since pulled back. I think the rest of this month is probably going to be about buying the dips, and it is worth noting that the 1.40 level also has its part to play.

The candlestick did give back quite a bit of the gains, but it is still positive for the month. The area above the 1.42 level extends towards the 1.45 handle. That is a 300-point range that will be very difficult to break above. In general, I think we are going to figure out whether or not the British pound is going to get a little bit closer to the historic norm of 1.50. This is a market that continues to hear a lot of noise, especially as the US dollar is being punished for the idea of stimulus. The market has had a very impulsive move to the upside, and it looks as if we may be running out of steam just a bit, but I certainly would not be a seller of this market as it is far too strong.

If the market were to break down below the 1.3750 level, then it could turn everything around; but right now, we have formed a massive basing pattern from which we have spent the last three months exploding to the upside. The noisy behavior is something that I think you should get used to in the Forex markets, because we are starting to see volatility pick up in multiple markets. If we do break above the 1.45 handle, then I think that will free up more buying as well, but I do not necessarily think we will see that during the month of March. The momentum is certainly what the buyers want, so unless something changes quite drastically, you simply cannot fight it. I have talked to several traders who have lost a lot of money trying to fade the “irrational moves” in the pound.