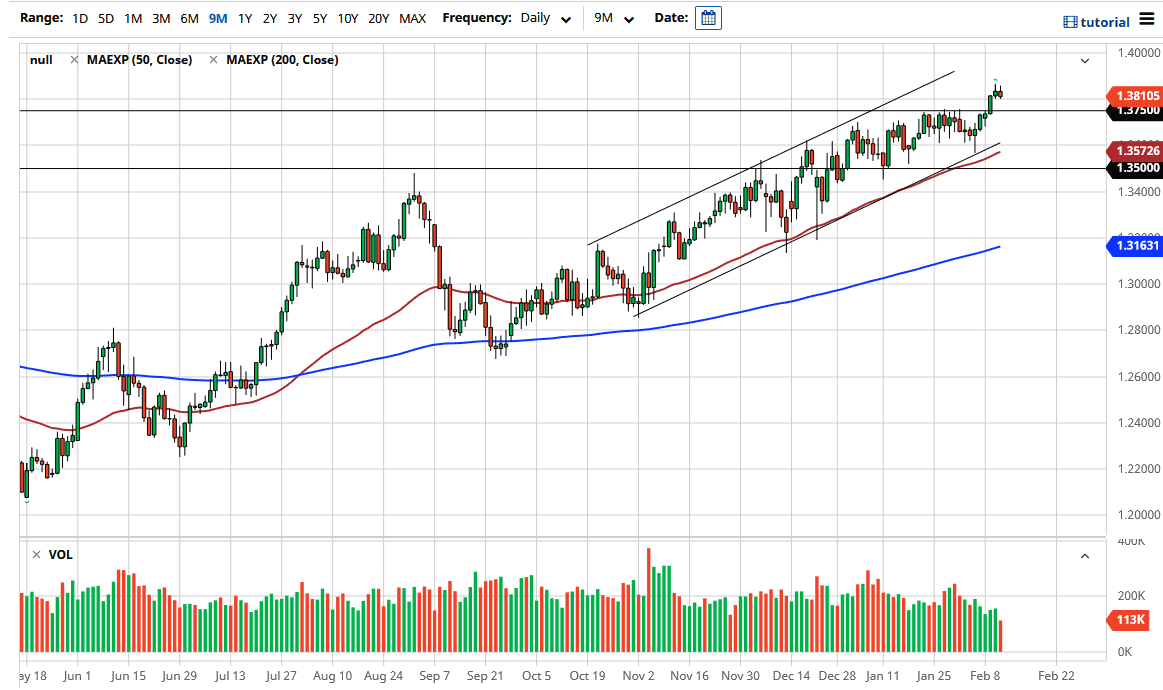

The British pound rallied a bit again during the trading session on Thursday but continues to find headwinds just above. This is interesting considering that we had just broken out so strenuously above the 1.3750 level, only to stall a bit. The question now is whether or not we can continue the overall attitude?

I do think we can, but it is obvious that is not going to be as easy as simply slicing through resistance and shooting straight up in the air. If that is going to be the case, then you may have to deal with a short-term pullback in order to find value again. One would think that the area near the 1.3750 level will offer a certain amount of support, and most certainly the uptrend line underneath will. The 50 day EMA sits just underneath that trendline, so I do think that it eventually will find buyers in this market. After all, that breakout was dead obvious, and a lot of people were waiting for it. I am a bit surprised that we have not been able to simply go higher, but in the environment that we find ourselves and I suppose anything should have been possible as nobody really knows what to do about global growth.

The United Kingdom is a slightly different and special case, due to the fact that it has been so stringent with releasing coronavirus shots for its public. As more people in the UK get vaccinated, the theory of course is that the economy will recover much quicker than some of the other G 10 peers. On the other hand, you do have to keep in mind that another thing that is pushing this up is the possibility of a weakening US dollar. If the US dollar continues to get hit on the idea of stimulus, that will probably only add yet another reason for this pair to go higher. Longer-term, as we have broken above the 1.3750 level, I feel that this is a market that probably goes looking towards the 1.40 level. That is an area that had attracted a lot of attention in the past, so I think a lot of people will be most certainly interested in that region again. Ultimately, this is a market that given enough time will try to find its way to that area, the question now is whether or not we need to break down a bit doing so? It is also worth noting that preliminary GDP numbers come out on Friday for Great Britain, so that could cause a little bit of volatility as well.