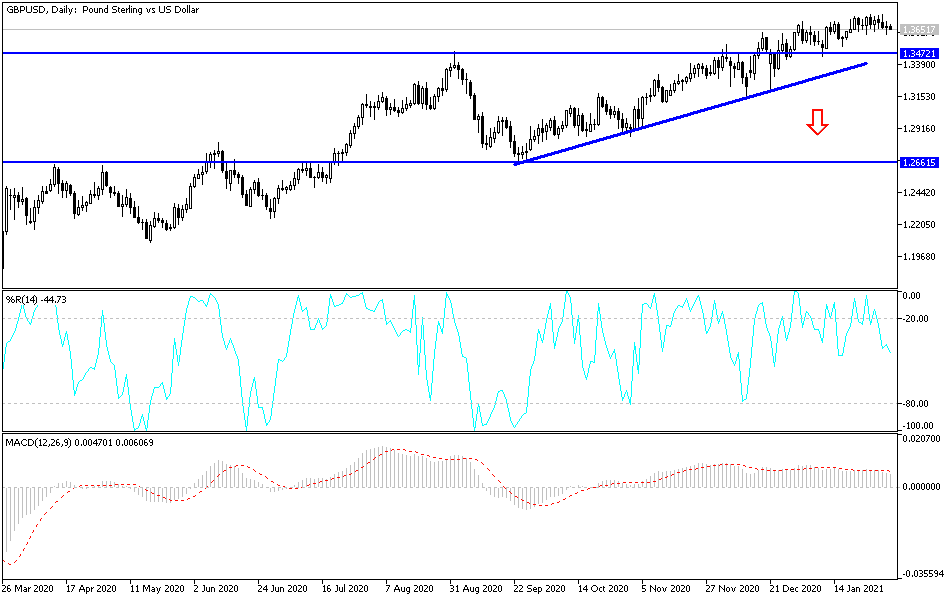

The British pound fluctuated during the trading session on Tuesday as we reached as low as the 1.36 level before recovering. The candlestick is somewhat neutral, and I think at this point it makes sense that we are simply going to stutter around this general vicinity. When you look at the chart, you can see I have a couple of lines drawn. The 1.3750 level on the top is significant resistance, while the 1.35 level underneath is significant support.

Looking at this chart, you can see that we have bounced around between these two levels, and I do believe that the 1.35 level is an area that people will be paying close attention to due to the fact that it is a large, round, psychologically significant figure. Furthermore, the 50-day EMA sits right there as well, so I think those are a couple of different reasons to believe that the market is going to be supported in that general vicinity.

To the upside, the 1.3750 level continues to be significant resistance, due to the fact that we have seen the market pull back from there multiple times over the last two weeks. Furthermore, looking at the longer-term charts, the 1.3750 level has been a significant level more than once. At this point, I think that we are simply trying to build up enough momentum to finally break out to the upside. If we can break above the 1.3750 level, then I think it opens up the possibility of a move towards 1.40 level after that. I believe that we go even higher than that once things settle down but, in the meantime, we are probably going to be very choppy and sideways.

The United Kingdom is starting to make headway as far as the coronavirus situation is concerned, which will be a major influence on where the pound goes. Furthermore, the US dollar has a part to play in this equation, and it certainly looks as if it is trying to find its footing. Because of this, I do not think that we are going anywhere as far as a bigger move in the short term, so I am looking at this as a range-bound back-and-forth market over the next several days or even weeks. If we do break down below the 1.35 handle, then it could kick off a more significant pullback.