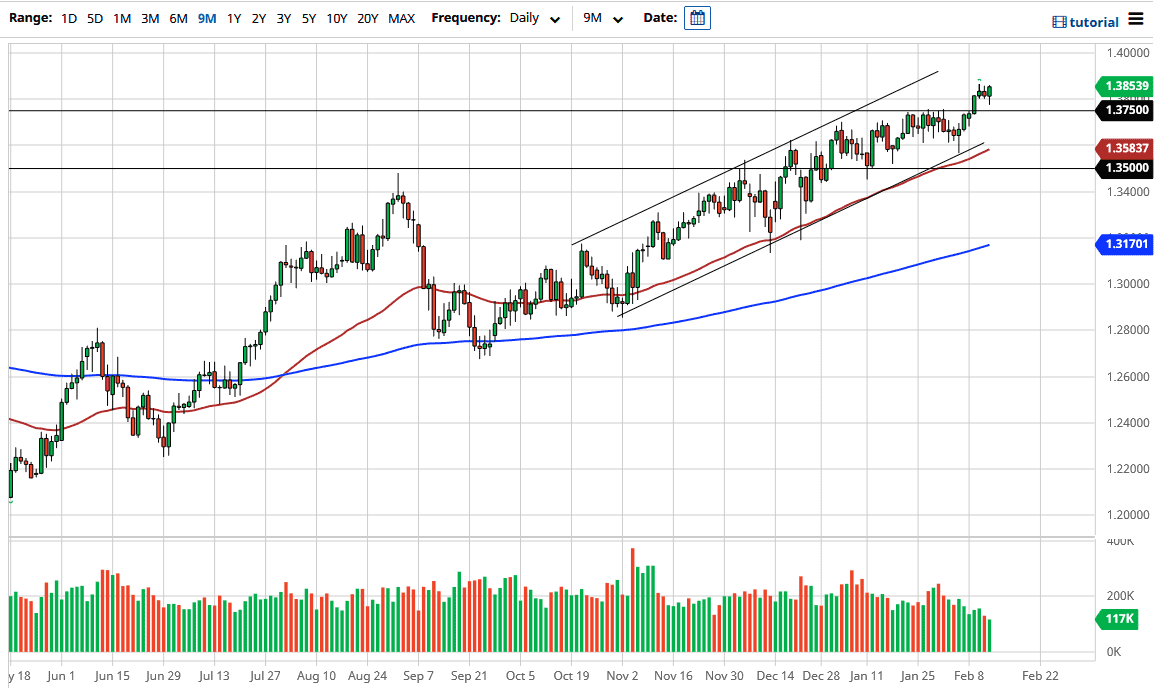

The British pound initially fell during the trading session on Friday, reaching down towards the 1.3750 level again. We found enough buyers just above that area to turn things around, as the market has reestablished the uptrend after what had been a rough couple of hours. With the UK GDP coming out better than anticipated, it certainly gave enough of a reason for people to get involved.

However, the market had broken above that 1.3750 level during the early part of the week, which has been a massive barrier that we could not overcome for quite some time. Now that we are above there and have dropped down to it only to find buyers, it does make sense that the British pound will continue to go much higher. I think that the target right now is probably going to be the 1.40 level, which has been important on the longer-term charts. It may take a while to get there, but at the end of the day, I do not see how we would not eventually get there due to the massive amount of stimulus that is coming out of DC.

Furthermore, the British economy is probably going to get a bit of a boost due to the fact that there have been a lot of vaccinations in that country, ahead of several of its counterparts. Beyond that, the idea is that the UK economy will open up quicker than several other economies, growing much quicker than places like the European Union. In general, the market is going to continue to see dips as buying opportunities, and I think that the 1.3750 level will now be considered to be the “short-term floor in the market” that we are paying attention to. Even if we break down below there, there is an uptrend line and the 50-day EMA coming into the picture. I do not have any interest whatsoever in shorting this market, although I do anticipate that we could get a bit of noisy bouncing around over the next several weeks. I do believe that the British pound continues to be one of the better performers, at least over the next couple of months. If we can break above that 1.40 level, then we are likely to go looking towards 1.50 level sometime towards the end of the year or even into 2022.