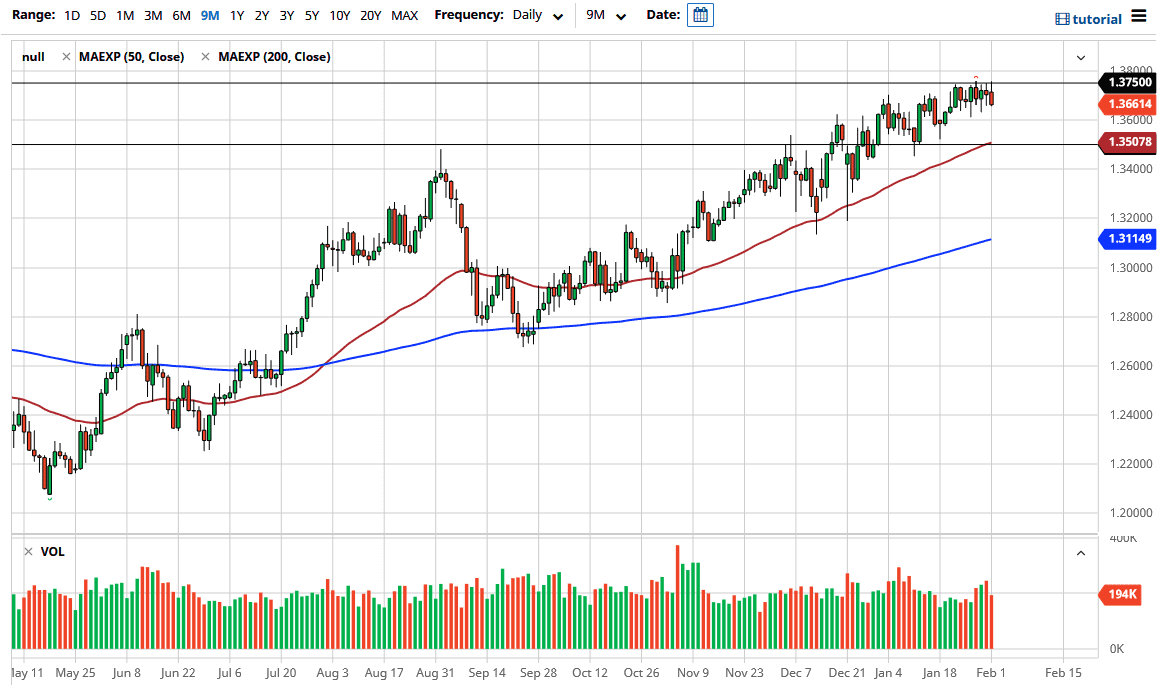

The British pound tried to rally during the trading session on Monday, but as you can see, it struggled during the session to keep the gains, breaking down towards the bottom of the range from the last week or so. While this is not necessarily the beginning of a massive meltdown, it does suggest that we are probably going to continue to see a little bit of short-term negativity. I do see significant support underneath that should come into play. This is especially true near the 1.35 handle, where we not only have a large, round, psychologically significant figure, but we also have the 50-day EMA.

The 1.36 level underneath also offers support, and I do not necessarily know that we are going to break down below there. However, if we did, then I would refer you back to the 1.35 level for a buying opportunity as well. You will probably have an opportunity to pick up the British pound “on the cheap”, as long as we can stay above the 1.35 handle. If we cannot, and we still have the US dollar strengthening around the world, then you can make an argument for perhaps a deeper correction.

There are a lot of concerns when it comes to the British pound and the British economy. However, one of the things that has been driving the British pound higher is that the vaccines have been distributed quite quickly in the United Kingdom. Although we are in the midst of lockdowns, the reality is that the COVID-19 virus is starting to abate a bit, and even though there was a different strand of coronavirus in the United Kingdom, it has turned out to be less drastic and dangerous than people had thought. At this point, I think the market is trying to build up a bit of momentum to finally break above the 1.3750 level. If we can, then the market is likely to go looking towards 1.40 level. Longer term, the market is likely to continue to see a lot of noisy and choppy behavior, but the British pound is going to try to get back to historical norms. At this point, I believe that waiting for some type of bounce after a pullback is what most traders are going to be interested in.