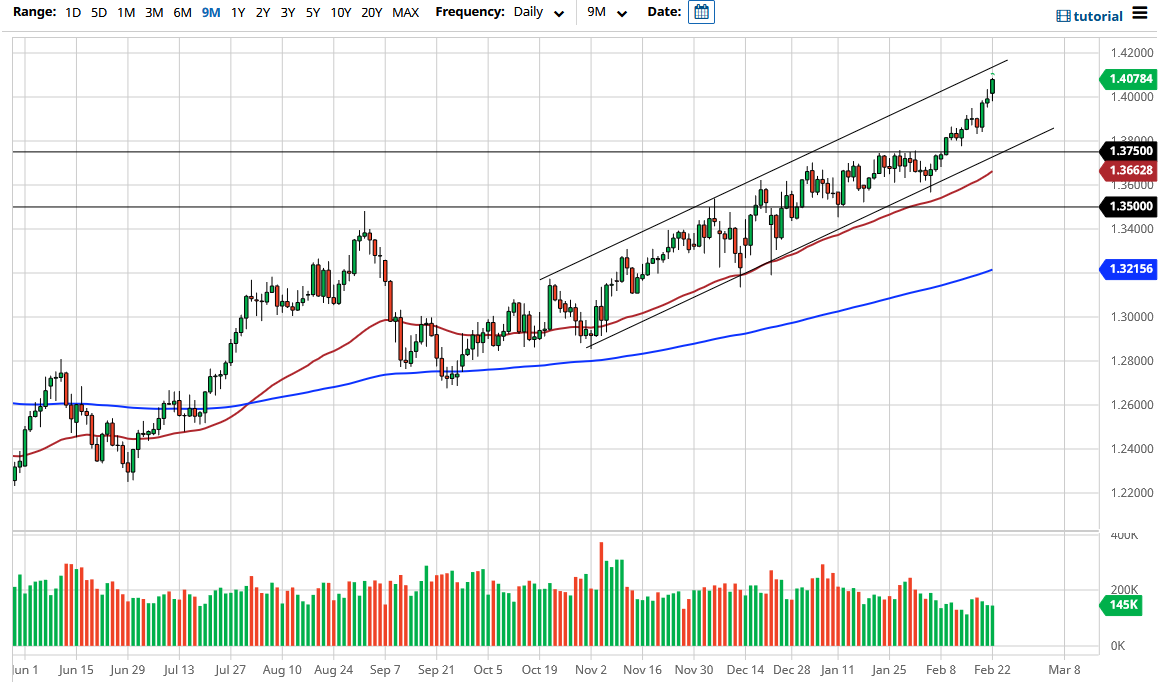

The British pound initially pulled back during the trading session on Monday but turned around to show signs of strength again. In fact, we have broken cleanly above the 1.40 level in general. This is a market that I think is probably going to be very noisy, but one thing that you can notice is that we have been a bit too bullish as we are in desperate need for some type of pullback. The 1.40 level obviously could be supportive, but we will probably pull back even further than that given the nature of the move.

The 1.39 level is an area that I think could be a nice candidate for support, and the 1.3750 level would be as well. In general, I have no interest in trying to short this market, and I believe that pullbacks will be looked upon as value. Furthermore, the 50-day EMA is reaching towards that 1.3750 level, so that only backs up the technical analysis as far as it being a “floor in the market.” Finally, we also have the uptrend line sitting just below there as well, so it is likely we will continue to see value hunters coming back in to take advantage of this market.

When you look at the British pound, it is a currency that is well underneath the historical norms, and one that represents the UK economy, so it should start to see a bit of a boost due to the vaccination program that the UK government has accomplished so far. The UK economy had been punished for the Brexit situation, which is for the most part settled. In other words, the death of the British economy was announced far too prematurely, and now that the Bank of England has stepped away from the idea of negative interest rates, that also causes a complete “rethink of the pound.” Furthermore, PM Boris Johnson has announced a slow opening of the economy starting in the next several weeks, so this gives even more optimism to the British pound. The bond markets have their say as well, as gilts have started to see higher rates, meaning that the British pound becomes a bit more attractive to foreign traders as well. Finally, you also have to think about stimulus coming out of America, and how it is going to hurt the greenback.