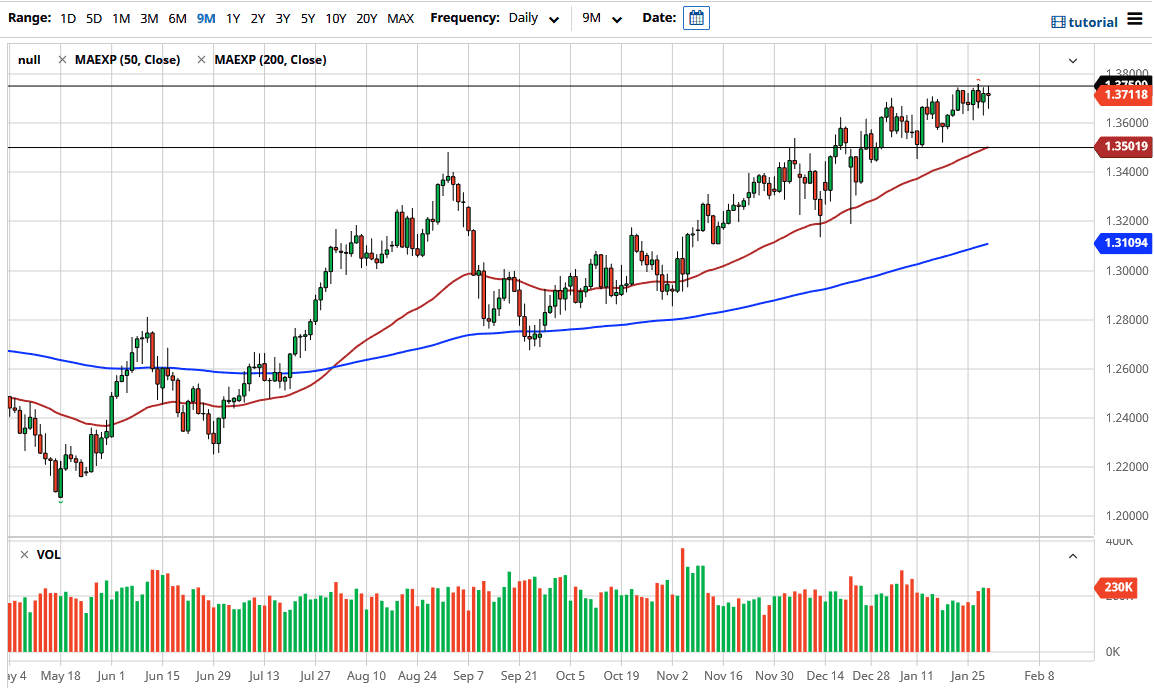

The British pound fluctuated during the trading session on Friday again as we continue to see the markets show extreme volatility. The 1.3750 level continues to be massive resistance, but I think the fact that we continue to bang up against it suggests that we are going to eventually break out. When we do, it could be a pretty violent move to the upside. I would anticipate at that point that the market would go looking towards the 1.40 level, which is the next large, round, psychologically significant figure and an area that has been important more than once.

To the downside, there is a significant amount of support near the 1.35 handle, not only due to the psychology, but due to the fact that it has been structurally important multiple times. The 50-day EMA sits right there as well, so it is only a matter of time before buyers would show up in that general vicinity. For what it is worth, even with the major “risk off” type of move that we had around the world during the trading session, the British pound held its own and actually had a “higher low” than the previous session. This suggests to me that there is still a lot of resiliency here, so I do not expect to see a return to the 1.35 handle. The noisy behavior is probably the biggest factor right now to consider, but when you look at the fact that the British pound had accelerated so far for so long, it does make sense that the market needs to go a little bit sideways and may struggle to break such a big resistance barrier right away. Nonetheless, we are in an uptrend, so we should eventually take off.

On the other hand, if we were to break down below the 1.35 handle, then it would be a significant turnaround. But right now, I just do not see that happening, due to the fact that the US dollar continues to be sold every time it attempts to rally. Furthermore, we are past Brexit and the British pound continues to be fairly undervalued, so I think that is also something that you should be paying attention to.