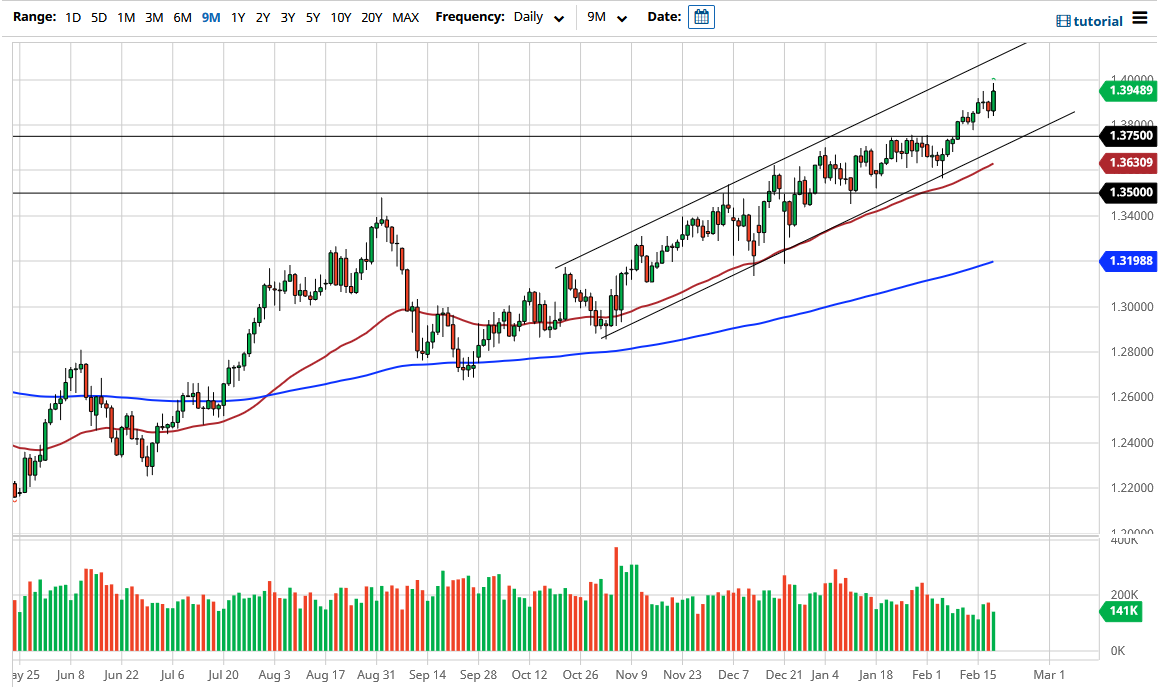

The British pound has rallied rather significantly during the trading session on Thursday after initially pulling back. We broke above the shooting star from the Tuesday session, which is a very bullish sign. We tried to get all the way to the 1.40 level above, which is an area where we would see a lot of options barriers at. Ultimately, the market should pay close attention to that round figure, but I think short-term pullbacks will continue to be bought into, as the trend is most certainly bullish, and has been for quite some time.

The United Kingdom is continuing to see a lot of bullish pressure due to the fact that the vaccination numbers are so high in the UK. Furthermore, Brexit has been passed through, and that gives us an opportunity for the economy to take off as it has been suppressed for so long. However, there have been lockdowns, so that is the one thing that people are probably worried about. Nonetheless, it appears that those lockdowns are going to be eased, and that could give yet another reason to think that the British pound goes higher.

When looking at the longer-term charts, the 1.42 level above would be resistance, and as a result I think that is where we are actually trying to get to. The 1.40 level will cause a little bit of psychology to come into play, but ultimately it is likely that we are going to go higher than that. To the downside, the 1.3750 level support should come into play as it was a major breakout recently. The uptrend line at the bottom of the channel is still coming into play, and the 50 day EMA is reaching towards the 1.3750 level as well. The one other thing to worry about is the fact that interest rates in the United States continue to rise, but in the end, it appears that the British pound is probably trying to get back to historical norms, which could be much closer to the 1.50 level. I have no interest in shorting, but if we were to turn around a break down below the 1.35 level, I would consider that a major trend change just waiting to happen. That looks to be very unlikely to happen anytime soon, so I think we continue to buy dips every time they appear.