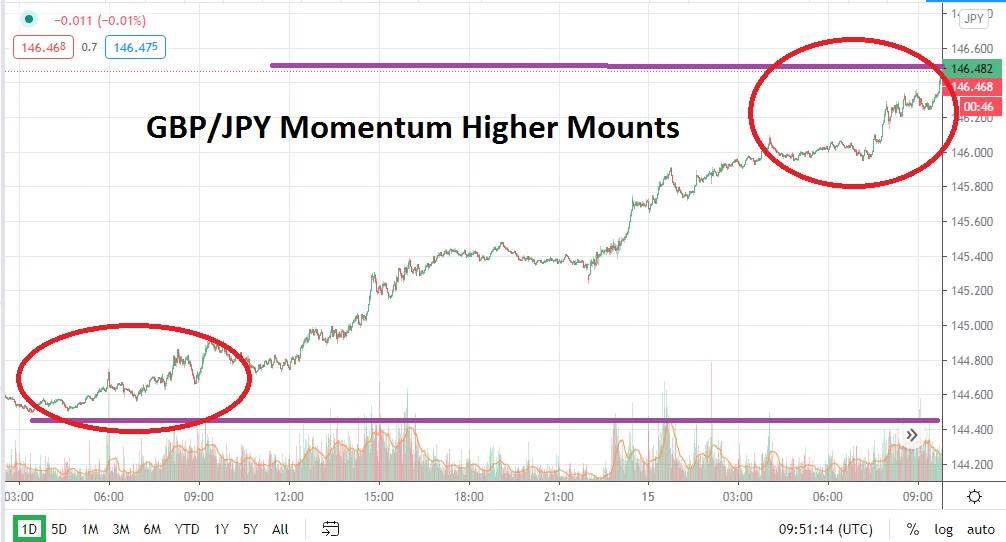

The GBP/JPY has seen another swift climb in trading today as important long-term resistance levels have been proven vulnerable. Bullish speculators of the Forex pair should look at technical charts from December 2019 to consider the next potential climb upward. The ability of the GBP/JPY to create a strong bullish trend appears to have speculative and fundamental thrusts powering the Forex pair higher.

Positive movement on global equities indices is proving that it has few roadblocks short term, and because of this, risk appetite within the GBP/JPY remains inclined towards favoring the British pound. The surge higher today in the GBP/JPY follows in the footsteps of gains achieved in a rather strong incremental fashion since late December. And since seeing a low water mark of nearly 142.800 on the 4th of February, which touched January’s high on the 27th, the GBP/JPY has produced rather consistent upward momentum.

After breaking through resistance late last week of 145.000, the GBP/JPY has surged again. Speculators who have been pursuing the bullish momentum may be asking if the price action has been too swift and may be anticipating a reversal lower in the short term as a natural reaction within Forex. However, traders are cautioned to use their risk management carefully if they are going to try and sell the GBP/JPY because it will be a decision to go against what has been a long-term trend.

Speculators who want to continue to pursue buying positions of the GBP/JPY are urged not to get too greedy and use limit orders which seek values within an appropriate proximity to current market values. Yes, the bullish trend may continue to propel, but traders should not let their winnings evaporate into thin air. While it is enjoyable to see winning positions and their values displayed on their trading platforms, it is often better to cash out gains and make sure they are not vulnerable to unexpected declines.

Having achieved a large move upward today, the GBP/JPY has created a targeted resistance near the 146.800 mark for buyers. The fast trading conditions within the Forex pair may remain volatile short-term as financial houses and their investors look for equilibrium. However, the bullish trend of the GBP/JPY suggests that resistance levels not seen since early in December 2019 are targets, and if values are sustained, the Forex pair may test prices seen in March of 2019.

GBP/JPY Short-Term Outlook:

Current Resistance: 146.800

Current Support: 145.750

High Target: 147.360

Low Target: 145.370