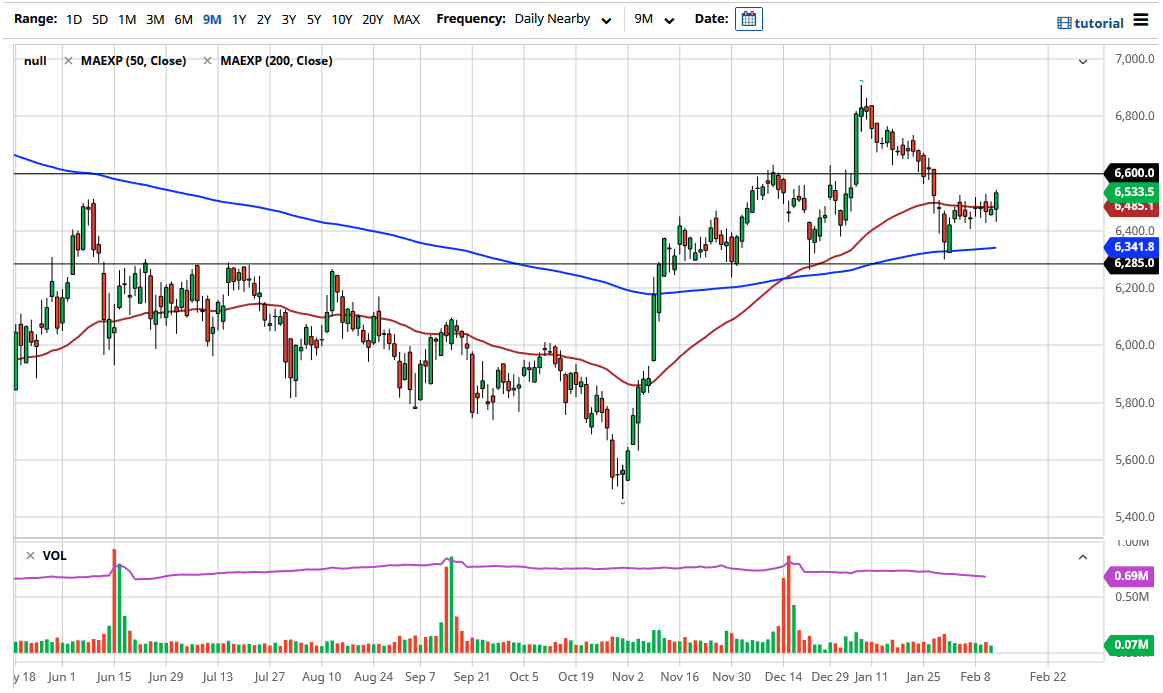

The FTSE 100 pulled back just a bit during the trading session on Friday to reach down towards the 6425 level. However, we have turned around completely during the day and have not only rallied, but have broken above the 6525 level that had been offering resistance as of late. By doing so, it suggests that we are going to go higher, perhaps reaching towards the 6600 level given enough time. I think that we will not only get there, but perhaps even break out above there to continue grinding higher.

Looking at the UK economy, we have seen a massive amount of vaccinations in that country that could force the opening of the economy much quicker than many of its counterparts. If that is going to be the case, then it makes sense that the FTSE 100 would rally in anticipation of the strength that should be coming. Beyond that, Brexit was not the apocalyptic event that everybody had tried to tell you it was, so there is a little bit of a relief rally from that alone.

However, there is one caveat in all of this, and that would be that the British pound is starting to show real strength. If the British pound continues to rally to an extreme, then it will weigh upon the FTSE 100 as exports coming from Great Britain will become much more expensive. As things stand right now, even though we have broken out in the British pound, we are still historically relatively cheap, so I do not think that is a major issue quite yet. However, it is something worth paying attention to going forward.

When you look at this chart, it is also worth noting that we are sitting on top of the 50-day EMA, but I think at this point this is a “buy on the dips” situation going forward and, if we get any sign whatsoever of the UK economy opening up sooner than anticipated, that will send this index to reach towards the recent highs at 6900 rather quickly. I have no interest in shorting the FTSE 100 anytime soon, as the 200-day EMA has offered a significant amount of support underneath. The 6285 level is what I consider to be the absolute “floor in the market.”