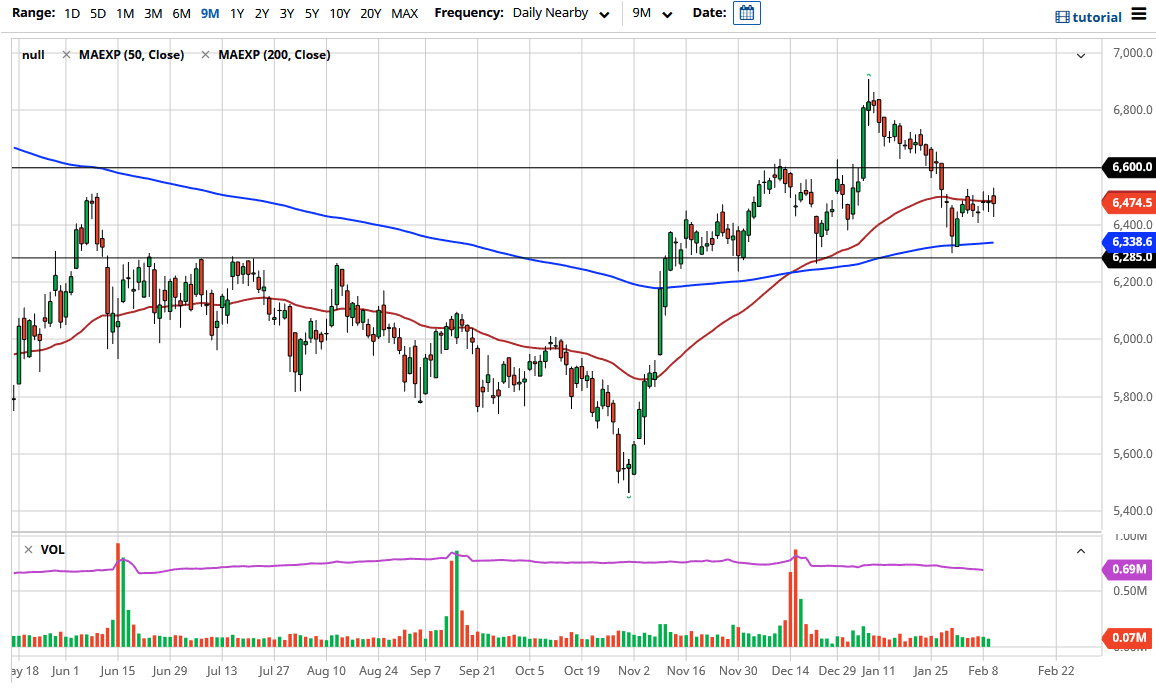

The FTSE 100 fluctuated during the course of the trading session on Wednesday, as we have been flirting with the 50-day EMA. This is quite often an indicator that longer-term traders will pay attention to, offering either dynamic support or resistance. When we are simply sitting at that EMA and it is going sideways, that tends to tell traders that the market is in an area that is trying to consolidate and perhaps find some type of new information to drive the market either higher or lower.

Looking at this chart, you can see that the 6285 level underneath is offered as support, just as the 6600 level above is potential resistance. In general, this is a market that I think will more than likely try to go higher, but the biggest problem that we have right now as far as the FTSE 100 is concerned is the British pound starting to break out to the upside in value. This does weigh upon the idea of British exports, but there are other things that the traders out there are focusing on, namely the fact that the United Kingdom has a huge jump on a lot of the other G10 economies when it comes to vaccinations. By that line of thinking, it extrapolates out to the possibility that the British economy will grow much faster than other ones, and therefore people looking for growth will be interested in the British stock market.

Furthermore, one thing that is becoming somewhat apparent is the fact that the British banking industry is not going to suddenly collapse now that they are leaving the EU, which was one of the big “doomsday scenarios” that a lot of the Remainers were pushing as a narrative. As with most things in the news, it was all hyperbole, driven by political ambition. At this point, it looks like there will still be a strong banking sector in the United Kingdom, despite the fact that we had priced the idea of a banking system as completely removed from international competition. I believe that as long as we can stay above the 6285 level, I am very likely to be more of a buyer on dips that anything else. If we can break out above that 6600 level, then it is very likely that we will go back towards the highs, which are closer to the 6900 level.