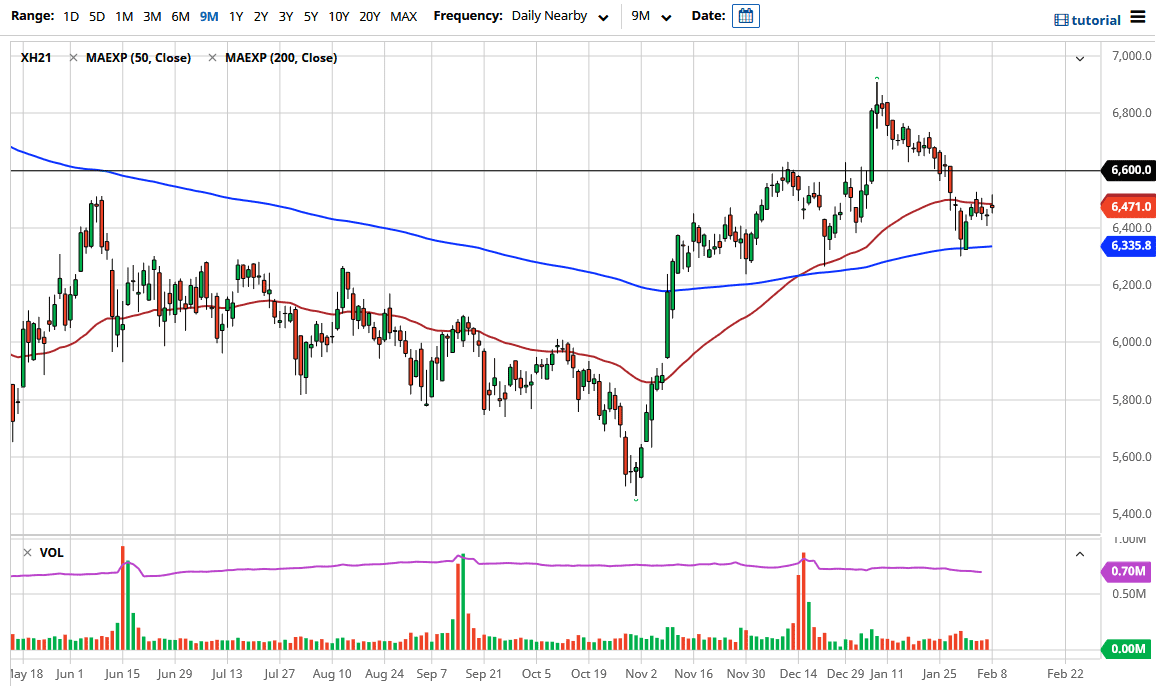

The FTSE 100 gapped higher to kick off the trading session on Monday to reach towards the recent highs but gave back some of the gains. We are currently hanging around the 50-day EMA at the 6471 level, which is something that is worth paying attention to. We have been trading between the 50-day EMA and the 200-day EMA for a couple of weeks now, with the 200-day EMA offering significant support. The candlestick for the trading session is a bit of a shooting star, which suggests that it will be difficult to keep going higher.

If we can break above the candlestick from both the Monday session and the Wednesday session of last week, then we can probably reach towards the 6600 level. If we can break above the 6600 level, then the market is likely to go looking towards the 6800 levels again. We also have massive support below at the 200-day EMA at the 6335 level underneath, which I believe is going to offer a bit of a “floor in the market” for the short term. You can also make an argument for a bit of a megaphone pattern, which can be negative due to the fact that it shows such extreme volatility. I am not overly concerned about that right now though, but it is worth noting that the British pound is trying to break out against the US dollar, and there could be some concern about whether this would hamper the exports coming out of the United Kingdom.

Nonetheless, we have a couple of clear barriers, namely the 200-day EMA and the 50-day EMA that we can use for signals in this market. I do think that it will probably follow the longer-term uptrend, but breaking above the top of the candlestick for the Monday session would also be a bit of a “double whammy” as far as the sellers taking a bath. If that is going to be the case, we could go all the way back up to the recent highs, as equities around the world continue to enjoy a “buy the dips” type of mentality. I do not see that the FTSE 100 would be any different, but it looks like we need to build up momentum in the short term to make that happen.