For five trading sessions in a row, the bulls have been trying to push the EUR/USD to move higher in light of the US dollar's decline and investor risk appetite. However, coronavirus-related restrictions and Europe's slow vaccination progress hinder bullish movements. The currency pair's gains did not exceed the resistance level of 1.2180, and during yesterday's session, it retreated to the support level of 1.2109, but continued the correction to the top, stabilizing around the level of 1.2170 at the beginning of trading on Thursday. Investor concerns regarding comments by the European Central Bank about the strength of the euro, which harms the economic activity of the bloc, are taken into account every time the currency pair moves up.

In general, expectations are still indicating the possibility of a rise of the EUR/USD, the most popular pair in the world, this year.

Commenting on the outlook for performance, investment bank Nomura says the euro will outperform the dollar in 2021, but those who want a stronger euro will have to be patient as the rally is likely to come later in the year. However, the investment bank's forecasts show that the pair may end the year near 1.30 from 1.20, the current level.

The EUR/USD pair rose during the second half of 2020, as demand for a safe haven from the dollar during market panic due to the virus gave way to trading recovery that brought the pair back to a psychological peak of 1.20. Jordan Rochester, Forex Strategist at Nomura in London, says: “The acceleration in trade flows in the past year is likely a major factor behind the strength of the EUR. But that was when financial flows were also supportive. This may not be the case now and that is why our conviction in the EUR/USD is lower now than it was. The range was restricted in February until the vaccine data accelerated.”

The EUR/USD pair has gone lower since January 06, when it hit a peak of 1.2349, prompting investors to question expectations that 2021 will be marked by a weak dollar. The Eurozone's balance of payments data for December confirmed Nomura's “suspicion” that investor flows in the Eurozone are accelerating, “making it difficult for the euro’s upward trend to continue at the same pace.”

But while the euro will likely struggle to gain momentum against the dollar, it is at risk of experiencing direct pressure against other cyclical currencies that have a high beta (i.e. positively correlated with equity markets). In this regard, Rochester says: "At the moment, we have a higher conviction that the euro will be weakening the bullish beta Forex performance."

Nevertheless, expectations for a recovery in growth in the Eurozone this year still lead them to expect a weaker US dollar.

The analyst believes that once the vaccination program in the Eurozone is accelerated, the US fiscal stimulus in early March is feeding the wider US trade deficit, and Mario Draghi may show signs of reform progress in Italy. The analyst also says that the EUR/USD is currently undergoing a tug-of-war between strong trade flows and weak financial flows. Nomura is currently betting on the euro against the British pound, saying that short selling the EUR/GBP is a preferred trade, as is the case for the EUR/AUD. The bank believes that euro optimists also expect the rise in the EUR/JPY and the EUR/CHF to stem from higher US commodity prices and yields.

Nomura expects the euro to be at 1.25 by the end of March/April, and to reach the level of 1.28 by the end of the year.

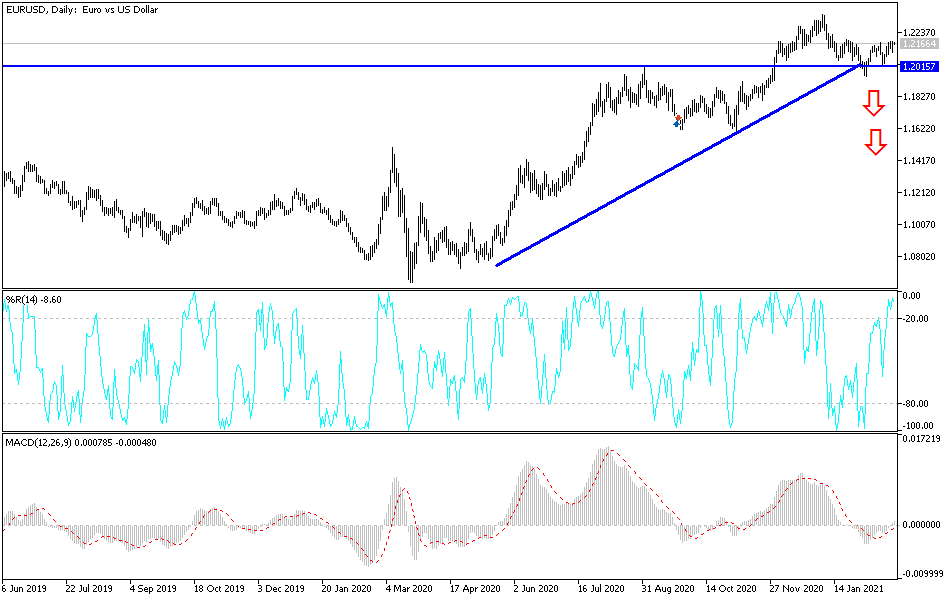

Technical analysis of the pair:

The trend is now in a phase of upward correction, but more momentum is needed to rush to ascending resistance levels, namely 1.2220, 1.2300 and 1.2385. This momentum will occur in the event that positive developments occur in the European vaccination plans to confront the epidemic.

On the downside, the bullish attempts will end if the bears move the pair's price below the psychological support level of 1.2000, and any hint from the monetary policy officials of the European Central Bank about the strength of the euro will end the upcoming euro's gains.

Today's economic calendar:

The GFK indicator reading on investor sentiment and money supply for the Eurozone will be announced. During the US session, the most important news will be the US economic growth rate, durable goods orders, US weekly jobless claims and pending US home sales.