The EUR/USD's upward correction path during last week’s trading resulted in testing the 1.2150 resistance level. With a lack of more momentum, it moved downward by the end of trading, reaching the 1.2081 support level before closing trading steadily around 1.2118. The pair bounced back on Friday to trade above the 100-hour and 200-hour simple moving average lines. It appears that the pair has also bounced back to avoid crossing over into oversold levels in the 14-hour RSI. In general, the euro is still lagging behind in achieving risk appetite gains in light of the European lag in its vaccination rollout, compared to the efforts of Britain, the United States and other global economies, which may affect the course of the European economic recovery in the coming months.

It was a quiet week in terms of important and influential economic releases. By the end of the week, it was announced that the preliminary Michigan Consumer Confidence Index reading for February was declining, with expectations for a reading of 80.8 and an actual reading of 76.2. Prior to that, it was announced that US jobless claims for the week ending February 5th exceeded the expected number of claims at 757,000, with a count of 793,000. Also, the continuing claims for the previous week were absent from the cumulative number of 4.49 million, with a total of 4,545 million claims.

As for the US inflation figures, the US CPI excluding food and energy for January eased. The expected change (monthly) was 0.2%, with a change of 0.0%. Consumer prices (year-on-year) were below expectations of 1.5% with a change of 1.4%. The general CPI for January came in below expectations (year-on-year) at 1.5% with a reading of 1.4% while its equivalent (monthly) was in line with expectations of 0.3%. Vacancies in the United States for the month of December outperformed the projected 6.5 million with a total of 6.646 million.

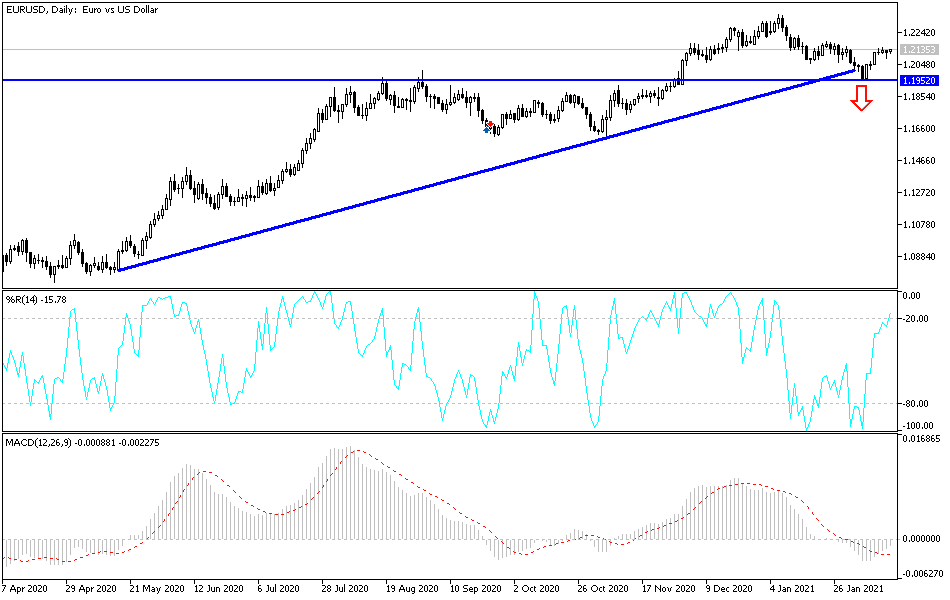

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD currency pair recently declined after a significant rise over the past week. The pair is now trading above the 23.60% Fibonacci level, after the bounce late Friday. Accordingly, the bulls are looking to extend Friday's late retracement towards 1.2133 or higher to the 0.00% Fibonacci level at 1.2150. On the other hand, the bears will target the gains for a pullback at the 23.60% Fibonacci level at 1.2100 or below at 1.2083.

In the long term, and according to the performance on the daily chart, the EUR/USD still appears to be trading within a rising wedge formation. This indicates significant long-term bullish momentum in market sentiment. The pair recently bounced off the trend line support after completing a bullish XABCD pattern. The bulls will target long-term gains around 1.2205 or higher at 1.2310. On the other hand, the bears will be looking to pounce on a potential pullback around 1.2005 or below at 1.1890.

Today's economic calendar:

From the Eurozone, the industrial production rate and trade balance figures will be announced. In the US, it is an American holiday and markets are closed.