Throughout this week's trading, the EUR/USD, was in a bullish correctional range, which pushed it to the resistance level at 1.2144 before settling around 1.2126 as of this writing. The currency pair's gains stalled despite the weakening of the dollar in light of the continued European restrictions to contain new strains of the coronavirus and the weakening of the European vaccination progress.

Yesterday, German officials agreed to reopen schools and hairdressers in the coming weeks, with much of the country's lockdown due to the pandemic extending until March 7, amid fears that new virus variants may reflect a decline in confirmed cases. Accordingly, German Chancellor Angela Merkel and the country's 16 states decided to leave many aspects of the current closure, which was scheduled to end on Sunday, and set a new goal of 35 weekly cases per 100,000 people before allowing small shops, museums and other companies to reopen.

The government's previous goal was to bring the number of new cases per 100,000 people each week to below 50, to enable reliable contact tracing. It peaked at 200 just before Christmas but is now down to 68 nationwide, a trend that Merkel credits with people respecting current measures.

However, officials agreed that the states will be able to reopen schools and kindergartens sooner, with some, such as Berlin, announcing that they will gradually resume teaching in primary schools starting February 22. Many governors have argued that the measure is necessary to relieve parents of the burden of home schooling and to ensure that disadvantaged children are not too late.

The country's tense medical staff warned against such a move. As before the meeting, the president of the German Interdisciplinary Association for Intensive Care and Emergency Medicine, or DIVI, warned that reopening schools and kindergartens would lead to a return of the virus.

The second lockdown in Germany began in November and was extended and tightened before Christmas due to concerns that the number of COVID-19 patients could overwhelm hospitals. With the extension, bars, restaurants and most stores will remain closed. Merkel said she will hold another meeting with the governors on March 3 to re-evaluate the lockdown measures again. On Wednesday, the German Robert Koch Institute reported that the country had recorded 8,072 new cases of the virus and 813 deaths within 24 hours. In all, Germany has seen more than 63,000 confirmed virus deaths during the pandemic.

Merkel said that Germany will closely monitor how the numbers of coronavirus cases develop in neighboring countries, noting that those in Poland have improved significantly and can now be compared to German figures. She expressed concern, however, about a cluster of cases in the Austrian state of Tirol involving a variant that was first detected in South Africa and which scientists say could be difficult to vaccinate against.

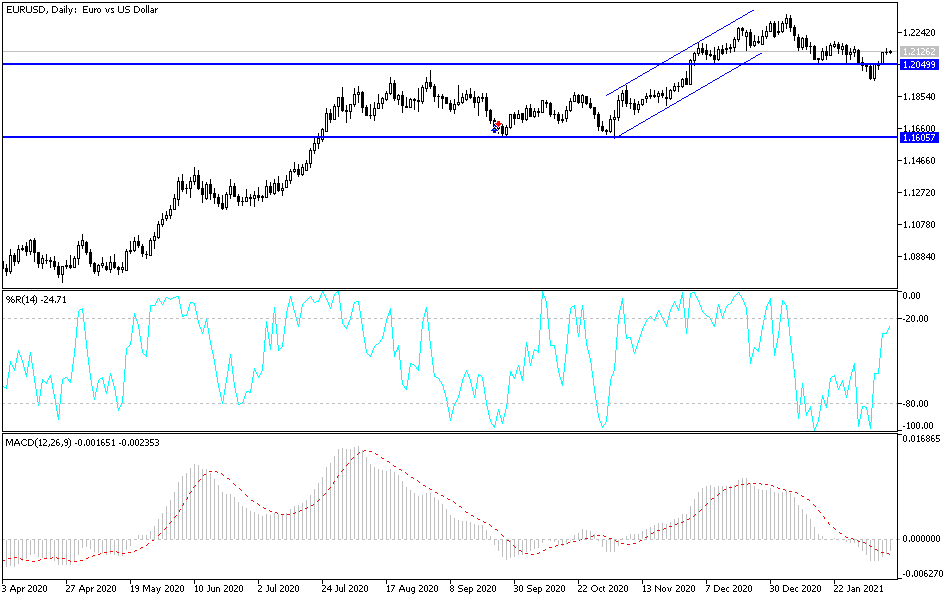

Technical analysis of the pair:

After the above explanation, it seems clear that the EUR/USD's gains will be under threat from COVID-19 restrictions and the European vaccination rollout. Its gains may be of interest to sellers, and the closest resistance levels for the pair now are 1.2185, 1.2235 and 1.2330. On the downside, the current general trend will turn bearish if the support level at 1.2000 is breached.

Today, the euro will be affected by the release of the European economic outlook and the announcement of the number of US weekly unemployment claims.