Bullish attempts to push the EUR/USD pair to stronger ascending levels are still weak. Despite the weakness of the US dollar and healthy risk appetite, the pair's gains did not exceed the 1.2180 level before settling around the 1.2150 level as of this writing. As I mentioned before, the European delay in vaccinations means a delay in the restoration of economic activity of the bloc, unlike what other global economies are heading towards. This is what has been worrying the euro.

The Biden administration is striving to increase vaccinations. In this regard, the makers of the COVID-19 vaccine have told the US Congress that they expect a big jump in dose delivery over the next month, and companies insist that they will be able to provide enough for most Americans to be vaccinated by the summer.

By the end of March, Pfizer and Moderna expect to supply the US government with a total of 220 million vaccine doses, a sharp increase from the 75 million shipped so far.

“We believe we are on the right track,” said Stephen Hoge, President of Moderna, explaining the ways in which the company has boosted production. "We think we're in a very good place." This is in addition to a third vaccine, from Johnson & Johnson, which is expected to get the green light from regulators soon. The Biden administration said on Tuesday that it expects to ship about 2 million doses of this vaccine in the first week, but the company has told lawmakers that it should provide enough single-dose options for 20 million people by the end of March.

Pfizer and Moderna expect to complete deliveries of 300 million doses each by the summer, and J&J aims to provide an additional 100 million doses. That would be more than enough to vaccinate every adult American, a goal the Biden administration has set. Two other plants, Novavax and AstraZeneca, have vaccines in the pipeline and expect them to eventually be added to these totals.

When asked explicitly if they were facing a shortage of raw materials, equipment or financing that would affect delivery times, all manufacturers expressed confidence that they had adequate supplies and had already addressed some of the early production bottlenecks. “At this point I can confirm that we are not seeing any shortages of raw materials,” said John Young of Pfizer.

Consumer prices in the Eurozone rose for the first time in six months in January, as initially estimated, according to final data from the European statistics agency Eurostat. The harmonized Consumer Price Index rose 0.9% year-on-year in January, reversing a 0.3% decline in December. A year ago, the rate was 1.4%. The final price was in line with the initial estimate published on February 3.

Prices rose for the first time since July, when the index rose 0.4%.

Excluding energy, food, alcohol and tobacco, core inflation accelerated to 1.4% from 0.2%. The base rate also matched expectations. On a monthly basis, consumer prices rose 0.2%, in line with preliminary estimates. In January, the highest contribution to the annual inflation rate came from services, followed by non-energy industrial goods, food, alcohol, tobacco and energy.

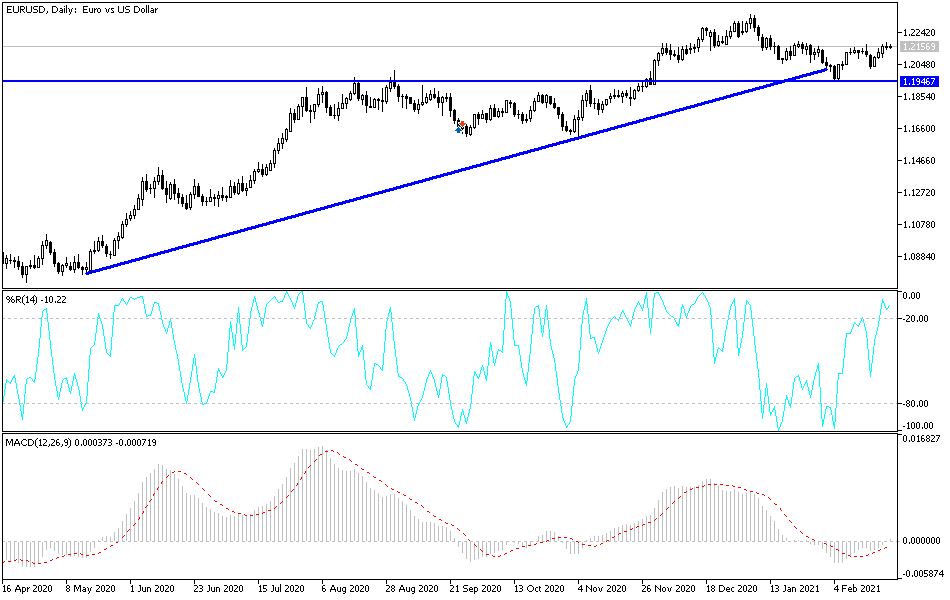

Technical analysis of the pair:

On the daily chart, the EUR/USD pair is still in an upward correction stage, and a breakout of the 1.2200 resistance will increase the bulls' control and find more buyers. which may push the currency pair to the resistance levels at 1.2245 and 1.2320 and 1.2400. On the downside, bears will not have a stronger control over performance without breaching the 1.2000 psychological support level.

The pair may remain in a waiting position until the announcement of a breakthrough in the pace of European vaccinations. Today, the pair will be affected by the announcement of the German economic growth rate, the content of the second testimony of US Federal Reserve Chairman Jerome Powell, and the announcement of new US home sales figures.