For three trading sessions in a row, the EUR/USD pair is moving in an upward correction range, settling around the 1.2085 level. Last week, sell-offs had pushed the pair to the 1.1952 level. The bounce in the currency pair came after disappointing results for the US labor market. All in all, the exchange rate's ability to recover 1.20 has impressed some traders who say that the strong response to the euro maintains a stronger upward trend. Nevertheless, for Roberto Milic, a Forex strategic analyst at UniCredit Bank in Milan, greater confidence will be created in the return of the euro if there is a move above 1.21 in the near term. “In the past, the breakout of the EUR/USD at a major level like 1.20 would lead to heavy selling. This time, it appears that the pair has found a floor at the 1.1950 support level and the weaker-than-expected US employment data was enough to lift it near the 1.2100 high."

In order to improve the outlook for the euro in the near term, the analyst says that the charts require the EUR/USD to restore the level of 1.21 and then stabilize again in the area of 1.21-1.2150. He also believes that the extent of the impact of the weak US jobs report on the recovery of the US dollar is expected to be one of the main topics of this week’s trading in the Forex market, but it is not the only issue.

The US dollar trimmed its recent gains against the euro, the pound sterling and other major currencies after the release of US jobs data which showed that the US economy added 49,000 jobs in January. The result proved to be a significant improvement from the -227K figure that was reported in December.

Until the recent past, the US dollar maintained a negative correlation with the rise in stock markets, that is, when investor risk sentiment was high and stocks rose, the dollar fell. The opposite is also true. When the markets drop, the dollar rises. Commenting on this, Milic says that the negative correlation between the dollar and stocks has weakened somewhat, as investors are now focusing more on a type of "vaccine spread trade." "This means investing in those currencies whose countries are advancing in terms of availability and distribution of the vaccine and borrowing in currencies whose countries face more problems with the introduction of the vaccine and are more vulnerable to new closure measures. Thus, this means investing in the US dollar and the British pound, while financing in the euro and Japanese yen.”

Milic warns that the Forex market has not yet established clear relationships and trends. UniCredit's strategy for currencies is still looking for global market sentiment, which is still poised to push currencies into the risky scenario we expect this year, and therefore remains bearish on the US dollar. The bank expects to see higher growth in the US than in the Eurozone, as the US economy is also expected to return to pre-COVID levels earlier than in the Eurozone. Accordingly, the bank lowered its forecast of the euro’s targets against the US dollar for the fourth quarter of the year 2021 and the fourth quarter of the year 2022, at 1.26 and 1.30, respectively.

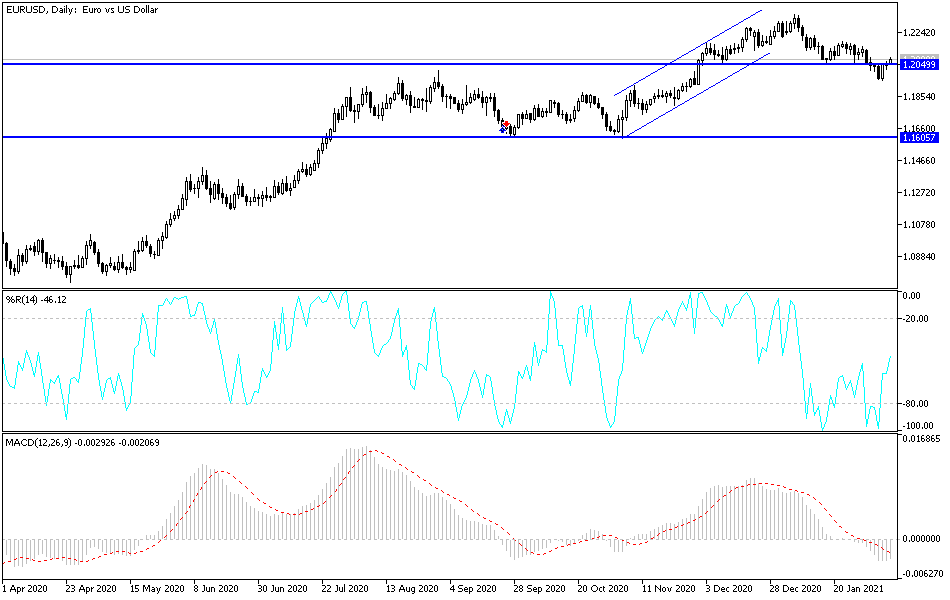

Technical analysis of the pair:

The stability of the EUR/USD pair at the highest level of 1.2000 will remain a catalyst for the bulls to launch higher. Despite the weakness of the US dollar today, the pair suffers from a lack of momentum due to the poor progress in European vaccinations, which may put them in a worse position than other global economies. The bulls' current targets are 1.2120 and 1.2200, and every high will be a selling opportunity, especially as the resistance level of 1.2300 pushes the technical indicators to strong overbought areas. On the downside, moving below the 1.2000 support level would push the bears to move towards stronger descending levels.