The EUR/USD sold off and retreated at the beginning of last week’s trading to the 1.2023 support level, then rebounded higher at the end of the week to the 1.2144 resistance level before closing steadily around 1.2117. Reports regarding vaccination and coronaivrus restrictions continue to dominate investor sentiment. The euro’s gains are still dependent on investor’s sentiment regarding the lagging European vaccine rollout compared to other global economies. A delay in vaccination means a delay in resuming economic activity, which will greatly harm the Eurozone.

The preliminary PMI from Markit in the European Union for February came in better than expected, with a reading of 48.1 against a reading of 48. The performance of the European Union's anufacturing PMI exceeded expectations with a reading of 54.4 with a reading of 57.7, while the Service PMI fell below expectations for a reading of 45.9, with an actual reading of 44.7. Prior to that, it was reported that consumer confidence in the Eurozone for the month of February beat expectations of -15, with a reading of -14.8. The preliminary European GDP growth for the fourth quarter outperformed both the (quarterly) and (annual) forecasts of -0.7% and -5.1%, with readings of -0.6% and -5%, respectively.

In the US, the Markit Service PMI for February beat expectations of 57.5, with a reading of 58.9. The Manufacturing PMI came in line with expectations of 58.5. Existing home sales and January home sales change also beat expectations. Earlier in the week, it was announced that US building permits for January exceeded expectations of 1.678 million at 1.881 million, while housing starts for the same period missed expectations of 1.658 million, with a record 1.58 million. The initial and continuing jobless claims also failed to match expectations.

January's personal income and consumption data is among the most important US reports this week. Income will be boosted by government repayment of the $600 billion authorized in the $900 billion stimulus bill that was passed at the end of last year. Personal spending will not keep pace but will likely rise for the first time since October. Although retail sales account for just under half of the GDP consumption component, the massive jump in January (5.3%, the first increase in four months, and outperforming the Bloomberg survey average of 1.1%) warns of the direction of major risks in personal consumption expenditures report.

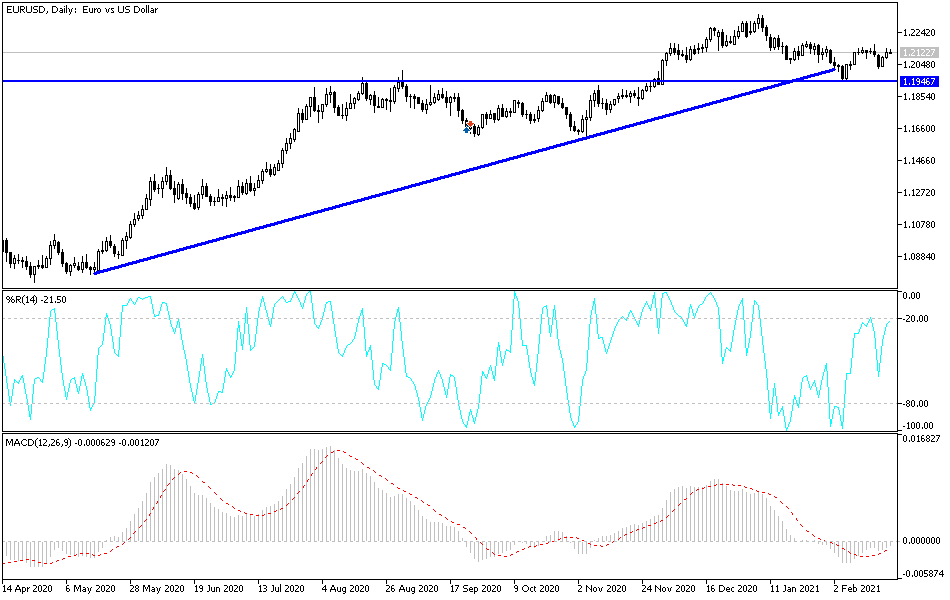

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD is trading within the formation of a bullish channel, which indicates significant short-term bullish momentum in market sentiment. Accordingly, the bulls are looking to extend the current uptrend towards 1.2148 or higher to 1.2169. On the other hand, the bears will target the short-term pullback gains around 1.2100 or less at 1.2078.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a bullish channel formation, which indicates a long-term bullish bias in market sentiment. The pair has now risen above the 100-day and the 200-day simple moving average lines. Accordingly, the bulls will target long-term gains around 1.2206 or higher at 1.2310. On the other hand, the bears will be looking to pounce on long-term pullbacks around 1.2005 or below at 1.1891.

The pair will focus on the announcement of the German IFO business climate reading, amid the absence of important US economic data.