The euro is still lagging far behind the pace of risk appetite that has dominated the markets recently, as gains from the EUR/USD's bullish rebound did not exceed the 1.2150 resistance level. The pair settled near that level as of this writing and ahead of the German ZEW reading. As I mentioned before, the euro is facing obstacles in the intensity of investor confidence due to the European delay in vaccinations, coinciding with the continuing record numbers of injuries and deaths due to new strains of the virus.

The EUR/USD is now trading in a narrow range with bullish risks after January's volatility, although the euro will have to deal with a series of major economic data points and the content of the meeting minutes for both the European Central Bank and the US Federal Reserve this week. The euro’s gains have been boosted since settling above the 1.2000 resistance since last week after profit-taking put it an inch away from collapsing below it in the last days of January. But perhaps the most frustrating thing to many regular observers is that the euro’s relationship with equity markets and other risky assets has been turned upside down, with the EUR/USD now falling in response to bullish moves in the equity markets and rising in response to the so-called “risk trade”.

This is an effective warning of how the euro exchange rate will behave against the dollar in a situation where there are many collapses and strikes in the stock and commodity markets and emerging market currencies. It is a strong indication that the EUR/USD pair may rise in response to these market conditions rather than decline, as has often happened in the recent past.

Commenting on the performance, Petr Krpata, Chief Forex Strategist at ING, said: “The EUR/USD has traded in very narrow ranges over recent days and this may continue during the first part of this week. The pressure may emerge following the release of the FOMC minutes, but a 1.2050 correction might be sufficient." Also, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank said: “EUR/USD is probing a 50% retracement at 1.2151, just below 1.2190,the high from 22 January. The market is consolidating here, and we believe that this is likely a barrier to reach 1.2556. Given that price action on Friday was around a major daily reversal, near-term risks are shifting to the upside."

Jones says the EUR/USD should find support now around 1.1945 in response to any weakness.

European currencies have proven to be common expressions of the economic contractionary movement in recent weeks, although the euro itself has been lagging behind due to the European Central Bank's concerns about the pace of its previous rally. Gains elsewhere in the European currency market helped ease upward pressure on the Trade-Weighted Euro (TWI) gauges, opening up space in TWI for further EUR/USD gains.

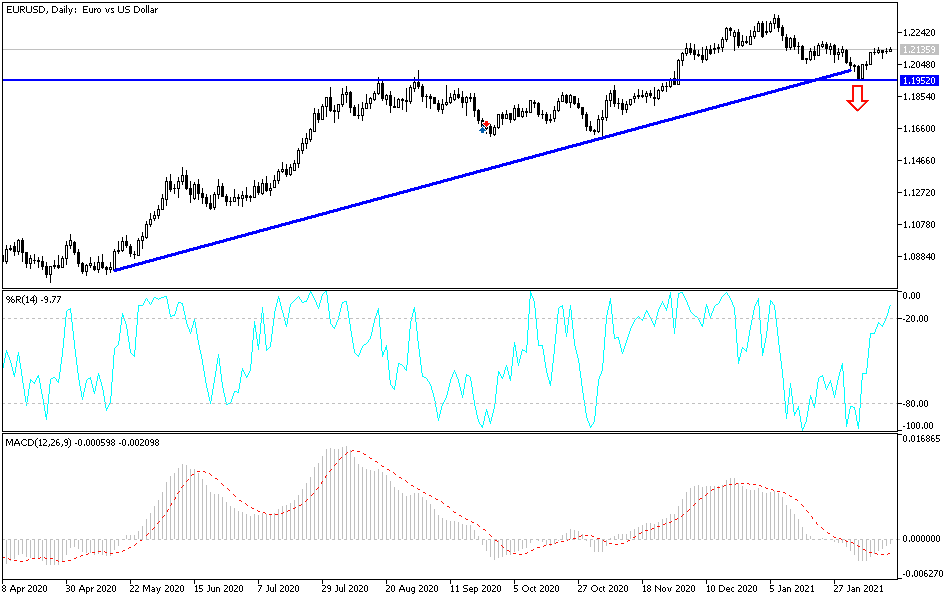

Technical analysis of the pair:

Despite the stalling of gains, the EUR/USD pair is still in an upward correction range, in need of further bullish confirmation, and this may happen if the currency pair moves above the resistance levels of 1.2220 and 1.2300. On the downside, the bears will control the performance if the pair comes back to test and move below the psychological support level of 1.2000. The pair will be affected by investors risk sentiment after the German ZEW reading and the GDP growth rate for the Eurozone.