Global risk appetite prompted the EUR/USD currency pair to correct upwards, reaching the 1.2170 resistance level before settling around the 1.2155 level at the beginning of Tuesday's trading. The positive reading of the German IFO Index was an additional impetus for the euro to achieve its gains against the rest of the other major currencies. The euro is recovering after experiencing volatility in January that contributed to the breakout of the most popular currency pair in the world below the 1.2000 psychological support level.

Commenting on the performance, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank said: "The Elliott wave count is more positive, provided we remain supported by the support provided from 1.2015, the highest level in September, and the support line at 1.2005. In that case, the bullish tendency will continue." On the upside, the market is capped at 1.2190, the January 22nd high. The level of 1.2190 is likely to act as a barrier to 1.2556, a 2018 high, and 1.2623, the 200-month moving average.

The 10% rise of the EUR/USD in mid-January was sufficient to make the ECB fear that it will be less likely to achieve the elusive inflation target over the next two years, given that stronger exchange rates could be lowered. Juan Manuel Herrera, Scotiabank Strategist, says: “Policymakers have recently spoken to the media (privately and publicly) about what looks like a campaign to implicitly end currency strength. The euro may remain weak, or lag behind its peers for a little longer, as the bloc lags behind the United Kingdom and the United States in the pace of vaccinations."

The euro has been on alert since ECB Governor Christine Lagarde said on January 13 that the European Central Bank was “very interested” in it, while various media outlets quoted other policymakers as saying that the bank may soon take measures to limit its rise. The concerns of the European Central Bank have become more acute due to the slow pace of vaccinations in Europe, which threatens to leave the continent's economic recovery behind others.

The EUR/USD pair has up to 20% of the trade-weighted exchange rate for the Eurozone (TWI), so the two-digit percentage rise in the past year has had a decisive effect in pushing TWI to its highest levels in the near decade. But the pound's rally, which represents 15% of the trade-weighted euro, has already relieved this pressure, and if it continues, it could lead to a rise in TWI so that the EUR/USD pair can rise again in the second and third quarters.

The official daily number of new COVID-19 cases in Portugal fell on Monday to less than 1,000 for the first time since early October, amid a national lockdown and just weeks after it was the most affected country in the world by population. In this regard, Andre Peralta Santos of the General Directorate of Health said in a televised meeting of health experts and political leaders that the closure, which began on January 15th, has led to a "very sharp decrease" in new cases.

The incidence of new cases in 14 days per 100,000 people has decreased to 322. At the end of January, it was 1628.

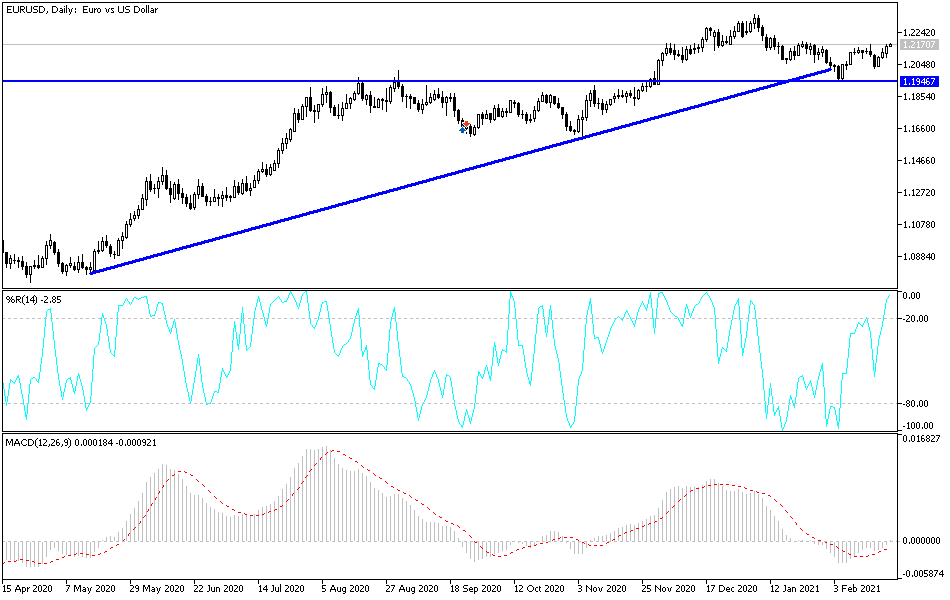

Technical analysis of the pair:

On the daily chart, the EUR/USD pair started forming an ascending channel, but more momentum is needed to strengthen this new trend, which will happen if the pair moves above the 1.2300 resistance. Bears will regain control again if the pair moves towards the 1.2000 psychological support. The performance is neutral with an upward slope. I think that this momentum may only come from a positive, strong development in European vaccinations, which will accelerate plans to open economic activity, which is the most important for the future of the euro in the coming months.

Today's economic calendar:

The Consumer Price Index will be released in the Eurozone. During the American session, the Consumer Confidence Index will be announced, followed by the testimony of US Federal Reserve Chairman Jerome Powell.