Bullish case

Buy the EUR/USD hoping that the momentum will continue.

Have a take-profit at the 1.2156 (January 29 high).

Set a stop-loss at 1.2050.

Bearish case

Have a sell-stop at 1.2087 (Tuesday low).

Set a take-profit at 1.2000 and stop-loss at 1.2200.

The EUR/USD is rising for the fourth consecutive day ahead of the important US and Germany inflation data and a speech by Jerome Powell. The pair is trading at 1.2127, which is 1.45% above last Friday’s low of 1.1953.

Inflation Data Ahead

The biggest catalyst for the EUR/USD will be the German and US Consumer Price Index (CPI) data that will come out at 07:00 and 13:30 GMT.

In Germany, economists polled by Reuters expect the data to show that the headline CPI rose from -0.3% in December to 1% in January. They also see the harmonized inflation rising to 1.6%, which will be slightly lower than the European Central Bank (ECB) target of 2.0%.

In the United States, economists expect the headline CPI to rise from 1.4% to 1.5% in January and the core CPI to rise to 1.6%. Like the ECB, the Fed has a target of 2.0%. Still, the Fed has committed not to start tightening as soon as inflation rises to 2.0%.

Still, stronger-than-expected inflation will be bearish for the EUR/USD because it will signal that rate hikes will come sooner than expected.

The EUR/USD will also react to the weekly US mortgage data that will come out at 12:00 GMT and the wholesale inventory numbers.

Also, investors are focusing on the upcoming stimulus deal in the United States. Democrats in Congress are working to accommodate concerns by moderate legislators who have opposed some of the provisions in Biden’s proposal. For example, they are adjusting the income levels of people who will be eligible for the $1,400 stimulus check.

The stimulus talks have accelerated after Friday’s jobs numbers that showed that the economy added just 40,000 jobs in January.

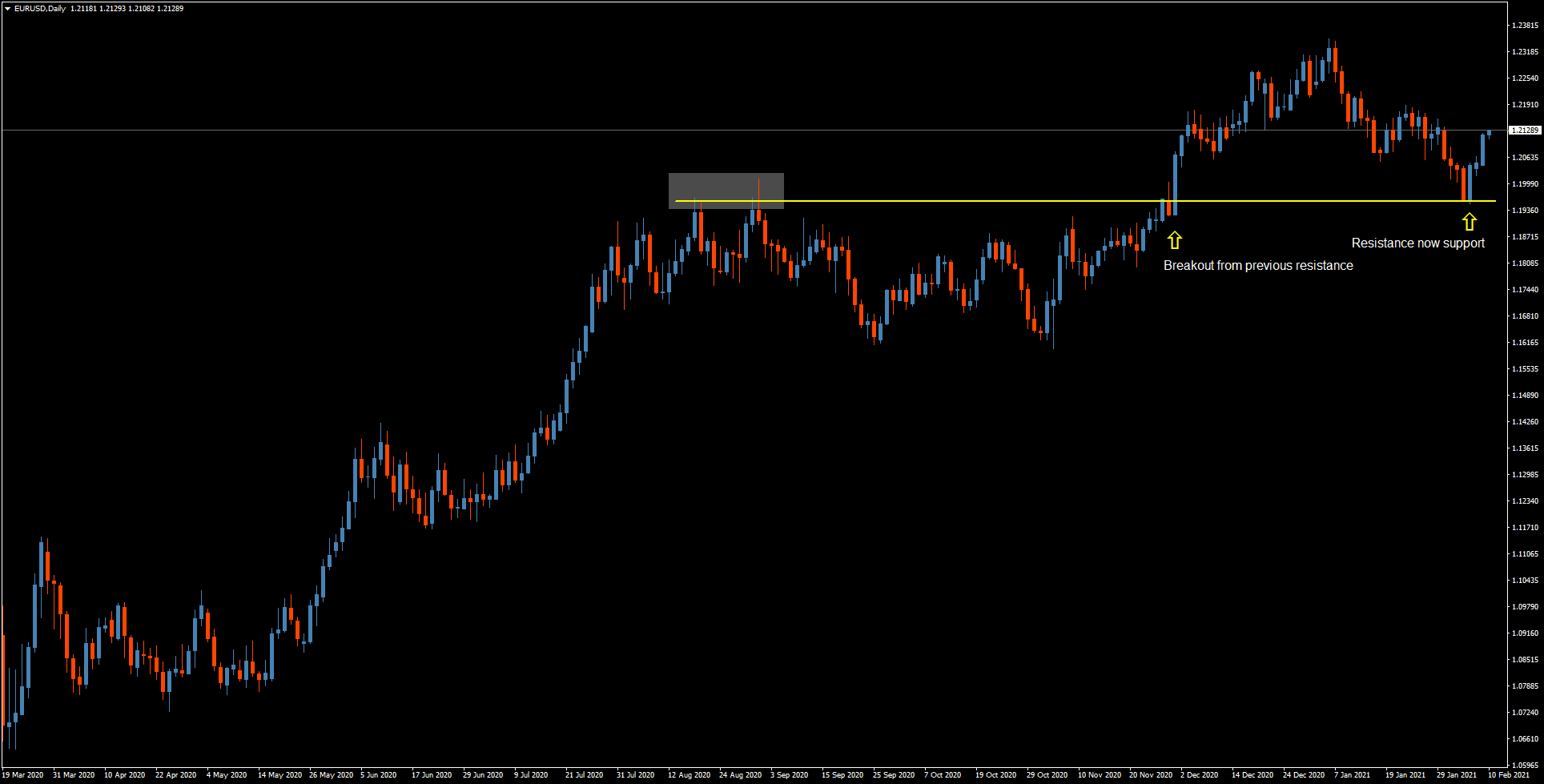

EUR/USD Technical Outlook

On the hourly chart, the EUR/USD price has been on an uptrend since Friday when the US published weak jobs numbers. On the hourly chart, the price has managed to move above the previous descending channel that is shown in blue. Also, the uptrend is being supported by the 15-period 25-period smoothed moving averages (SMMA) while the Relative Strength Index (RSI) is hovering near the overbought level.

Therefore, the pair will likely continue rising as bulls target the next resistance at 1.2156. However, with important inflation numbers coming out, we should not rule out a short-term bearish reversal.