Bullish Case

Buy the EUR/USD after it crossed the important resistance at 1.2170.

Add a take-profit at 1.2250 and stop-loss at 1.2150.

Timeline: 1 to 2 days.

Bearish Case

Set a sell-stop at 1.2150 and a take-profit at 1.2100.

Add a stop-loss at 1.2250.

The EUR/USD is rising for the fourth consecutive day ahead of important testimony by Jerome Powell and the EU consumer inflation data. The pair rose to 1.2170, which is 1.3% above the lowest level on Wednesday last week.

Jerome Powell Testimony and Rising Yields

The EUR/USD is rising mostly because of the weak US dollar. The closely watched US Dollar Index dropped below the important $90 milestone in the overnight session as traders focused on the rising US yields.

In the past few weeks, the short- and long-term US treasury yields have been rising. Indeed, the gap between the 5-year and 30-year Treasury yields widened to the highest level in more than five years. This trend is mostly because investors expect interest rates to rise earlier than expected because of the ongoing expansionary policies by the Fed and US Congress.

The Fed has brought interest rates to near zero and boosted its balance sheet to more than $7.3 trillion. At the same time, Congress has passed more than $4 trillion in stimulus and is in the process of passing another $1.9 trillion package. After this, there is talk of further indirect stimulus through infrastructure spending.

As a result, in addition to the large twin deficit, there is the fear of high inflation. The most recent data showed that the overall inflation in the United States rose to 1.4%. Analysts now expect the Fed’s target of 2% to be reached later this year.

The EUR/USD is therefore rising as traders wait for answers from Jerome Powell, who will testify at a Senate committee hearing later today.

It is also rising ahead of the latest EU inflation numbers. Based on the flash CPI released earlier this month, analysts expect the headline CPI to rise by an annualised rate of 0.9% in January. This will be an improvement after the 0.3% decline in December. Similarly, the core CPI is expected to increase from 0.2% to 1.4%.

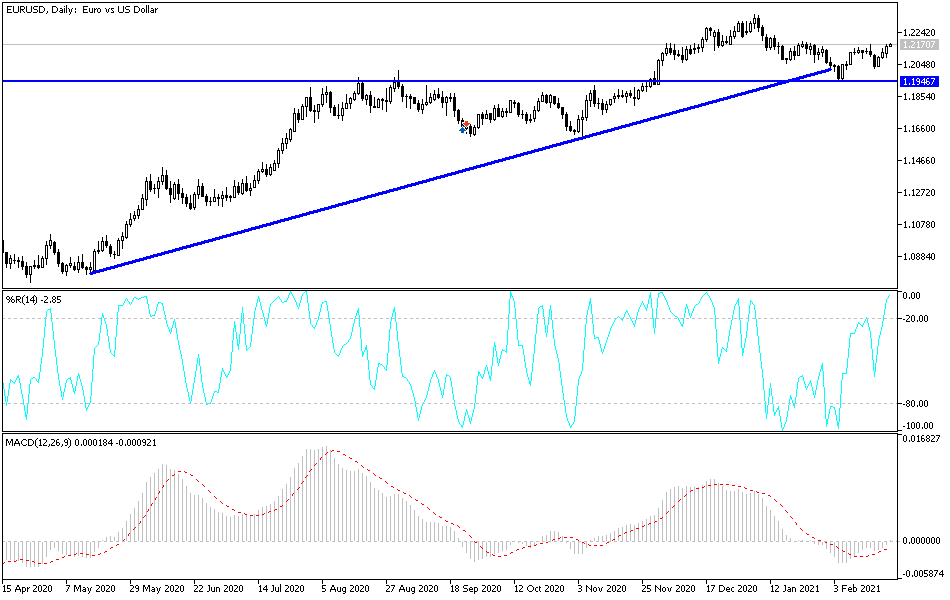

EUR/USD Technical Outlook

The EUR/USD pair rose to a high of 1.2175, which was the highest it has been since January. The pair moved above the important resistance levels at 1.2145 and 1.2170. The uptrend is also being supported by the 15-day and 25-day exponential moving averages. It is also being supported by the rising red trendline. Therefore, the pair will continue rising so long as the price is above the averages and the trendline. As such, the next key level to watch is 1.2200.