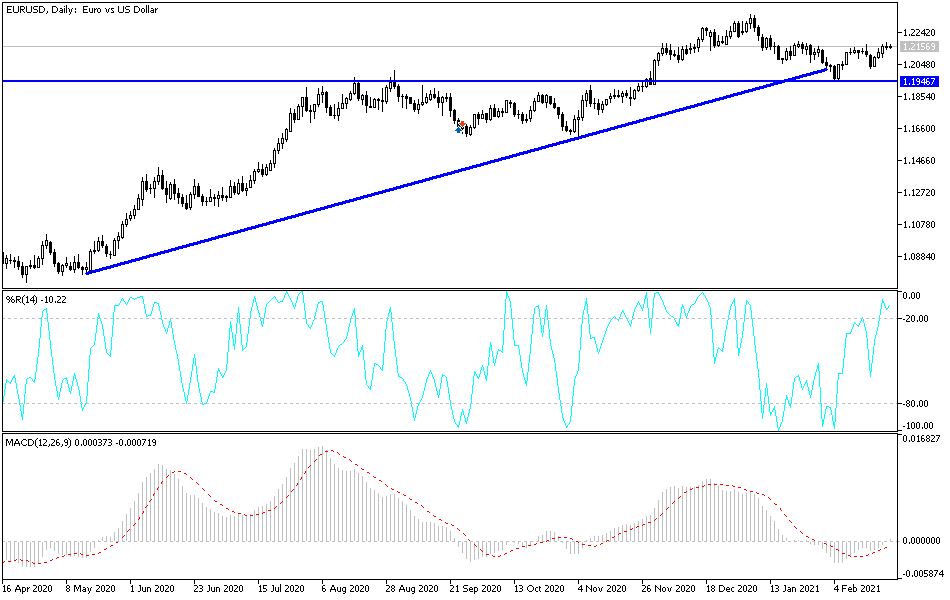

The euro initially rallied during the trading session on Tuesday but gave back the gains as we got close to the 1.2175 handle. The shooting star suggests that we could pull back just a bit, but I think what we are looking at here is a market that is trying to turn around and break the neckline of an inverted head and shoulders pattern. If we do, that opens up the possibility of a move closer to the 1.24 handle, which is well within the resistance barrier that I see between 1.23 and 1.25 above.

On the other hand, if we were to break down below the bottom of the candlestick for the trading session on Tuesday, then I think we will probably go looking towards the 50-day EMA, possibly even as low as the 1.20 level after that. In general, I think what we are seeing here is a representation of just how uncertain most traders are around the world. The noise in the market has a huge amount of factors involved in it, not the least of which would be the 10-year note yields which have provided a bit of a boost for the US dollar as the interest rate differential favors America. On the other hand, the stimulus package coming out of the United States will more than likely devalue the greenback, and that has been shown over the last couple of weeks.

The 50-day EMA sits near the 1.21 handle, and that could offer a little bit of support, but the one thing that you see here in the moving average is that it is sideways, suggesting that perhaps the market is going to consolidate more than anything else at this point. The euro shot straight up in the air against the Swiss franc during the trading session, but it was much less impressive over here, so that tells you that there is still a certain amount of demand for the US dollar, and therefore I think it will keep this market somewhat choppy and sideways. The market has been in a roughly 300-point range for a while, and I do not see us breaking out of it anytime soon, as there are so many different moving pieces that it is difficult to get overly confident about one direction or the other.