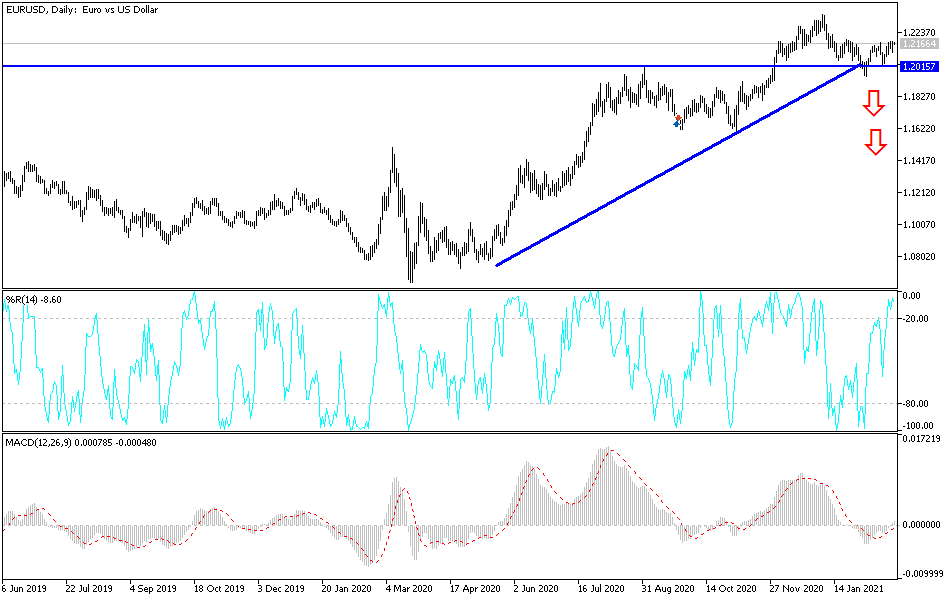

The euro fell a bit during the trading session on Wednesday to reach down towards the 50-day EMA. By reaching down to that area, we attracted a bit of value hunting and rallied enough to form a hammer. The hammer is a very bullish sign and I think that it is only a matter of time before we break above the 1.22 handle. If we do, that kicks off an inverted head and shoulders, which should open up a move towards the 1.24 handle. While that is a fresh, new high, it does not break out for a significant longer-term move.

The resistance above is at the 1.23 level that extends all the way to the 1.25 level, so I think there is a lot of work ahead of the euro to continue going higher. The idea of stimulus in the United States may be a driver to push this pair higher, but really at the end of the day the biggest problem with simply buying the euro here is that the European Union has been struggling with lockdowns occasionally, and a lag in the amount of vaccinations that have been administered.

The 50-day EMA sits underneath and offers support, and seems to be grinding sideways which suggests that the market has nowhere to be in the short term. Looking at this chart, I do think that it is only a matter of time before the buyers get involved, as it seems like the US dollar continues to get hammered against almost any currency that it faces. Even if we do break down below the 50-day EMA, the market is likely to go looking towards the 1.20 level, which is an area that should see support extending all the way down to the 1.19 level underneath. If we were to break down below the 1.19 level, then it is likely that the next stop would be down at the 200-day EMA, which is currently sitting at the 1.18 handle. I think we will see more bouncing around in this market, but it certainly looks as if short term it has more of an upward proclivity than anything else. I do believe that the market is trying to build up enough pressure to at least clear the 1.22 handle.