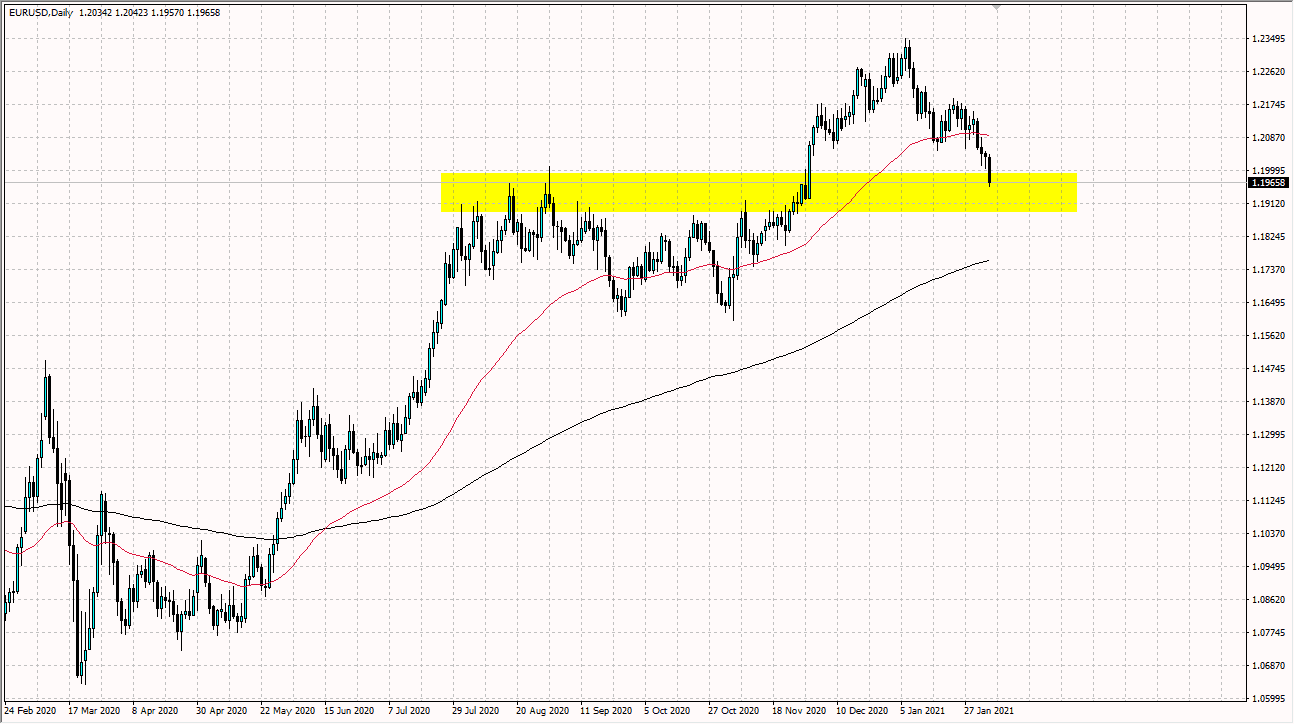

The Euro has broken down below the 1.20 level during the trading session on Thursday, as it looks like we are going to continue to see a lot of volatility in this pair. When you look at this chart, you can see that I have yellow box on it, and I believe that it signifies where all of the support should be. The area between 1.20 and 1.9 is essentially a “thick zone of potential support.” This is because it behaved like a “thick zone of resistance” previously.

The candlestick for the Thursday session of course is very negative looking as it is where we broke down through a couple of hammers, and of course we have closed towards the bottom of the range. All things being equal, that is a very negative sign and if it were not for a couple of factors, I would be all in at this point and shorting. The biggest problem of course is the structural support down to the 1.19 level, but we also have to worry about the Non-Farm Payroll figures coming out on Friday, and that will make quite a bit of volatility jump into the marketplace. I think by the time we closed business on Friday, we will probably have a much clearer picture of what is going on.

If we can turn around and break above the top of the candlestick on a daily close from the Thursday session, then it is likely that we go higher, and that the longer-term uptrend continues. Previously, I had looked at this as a market that is consolidating between 1.23 on the top and 1.20 on the bottom. So far, we are still essentially still in that same region, and therefore I think it is only a matter of time before we at least make an attempt to go higher, but ultimately this is a market that could be turned around due to the fact that interest rates in the United States are spiking, and of course we are seen the US dollar rally against multiple other currencies as well. Furthermore, the European Union is struggling due to the coronavirus lockdowns and the lack of speed when it comes to the distribution. We could be possibly looking at a potential trend change, but I am not going to be aggressive to the downside until we clear the 1.19 level.