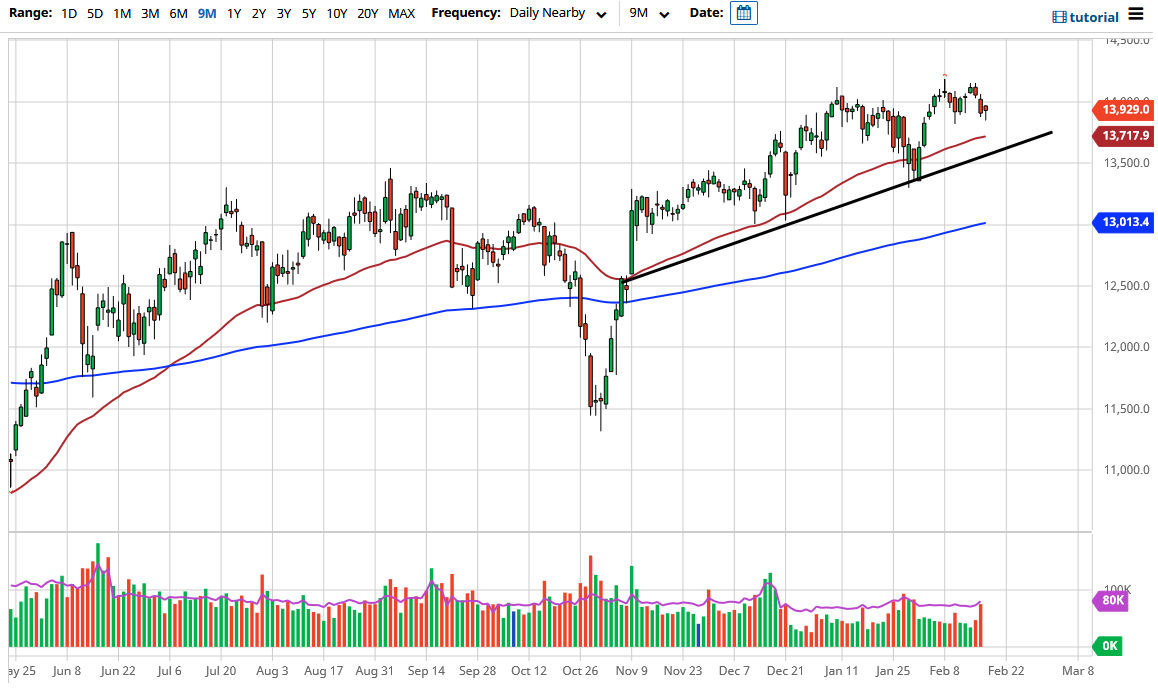

The German index initially fell during the trading session on Thursday but has turned around to show signs of life again just below the 13,900 level. This is an area that has offered support recently, and therefore I think it will continue to be something that people will be looking at as a potential support region. Ultimately, this is a market that I think will try to recover and break out above the top of the recent consolidation area. If we get that, then we will leave the 14,000 level in the background, and it is likely that the market will go towards the 14,500 level next.

Keep in mind that the DAX continues to see inflows due to the idea of the global reflation trade, as Germany is a major exporter of industrial goods, which of course will be needed everywhere if we do in fact see a turnaround. With the European Central Bank out there looking to throw money into the fray as well, it is likely that we will continue to see liquidity driving prices higher when it comes to stocks on the continent, and of course Germany is the first place people look towards.

The candlestick for the day of course is a hammer, so that in and of itself will have people are paying close attention to the market, as it is such a common candlestick pattern to trade for buyers. That also means that if we break down below the bottom of the candlestick it would be a very bearish sign, perhaps sending the market down towards the 50 day EMA. The 50 day EMA also is backed up by the uptrend line, so all things being equal I think there is only a matter of time before we see buyers jumping back into the market to try to get some momentum to the upside. It is not until we break down below the 18,250 level that I would be a seller, and even then, I would be a bit cautious. I do believe that the easiest path is higher, but it is probably going to be very noisy and choppy, so that makes quite a bit of sense that we would see a lot of range bound trading in the short term to try to build up the necessary momentum to make the next move.