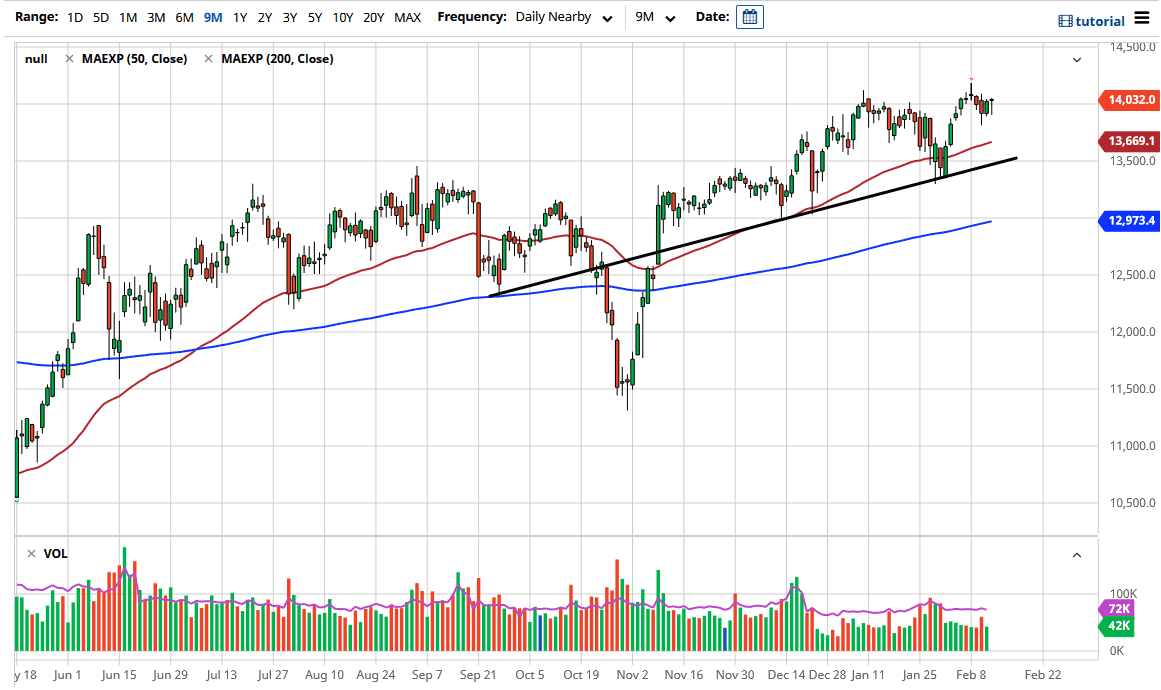

The DAX Index initially fell during the trading session on Friday but has found buyers again at the 13,900 level. This is an area that has been short-term support, as we continue to bounce above the 14,000 level. If we can break out above there, then it is likely that we will continue to go driving towards the 13,500 level, and then eventually the 15,000 level. Keep in mind that the DAX is considered to be the “blue-chip index” of the European Union, so it is only a matter of time before we see money flow into this market due to the fact that bonds simply do not offer enough yield, and people will be looking for a safer index to be involved in.

Beyond that, the idea of the reflation trade will lift the DAX, due to the fact that so many of the major players in the DAX will be export-driven companies coming out of Germany, which is a huge industrial producer. If that is going to be the case, then dips will continue to be bought into, and I think it is only a matter of time before we break above the shooting star for the Monday session. If we can break above there, then that will be the sign that we are ready to go much higher. In the meantime, I like the idea of buying dips, all the way down to at least the 50-day EMA, if not the uptrend line underneath there. This is a market that I think will go looking towards much higher levels due to the fact that it looks like stock indices around the world are trying to break out to the upside yet again.

I have no scenario in which I'm willing to short stocks in general, and the DAX is no different. I have no interest whatsoever in trying to short the DAX until we see some type of major recessionary concern coming out of the European Union. Yes, we have lockdowns going on, but it seems like the market is willing to look beyond that at the moment, and I think you are looking at a scenario in which you simply look for dips because they will end up being “cheap” before all is said and done.