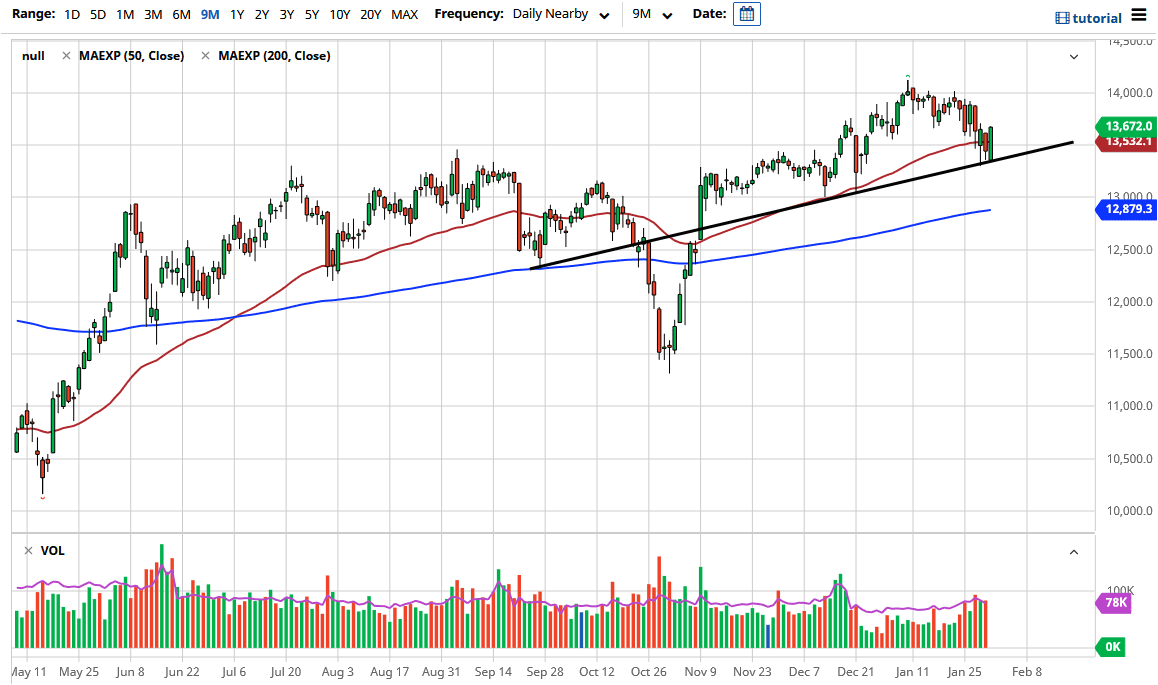

The DAX Index bounced during the trading session on Monday after initially gapping lower. In fact, this is a market that has shown plenty of momentum during the day, wiping out the initial drop lower, and putting the short-term sellers on their back foot. We are above the 50-day EMA, which is also a positive sign, as we have found a massive uptrend line to hold things intact.

The German index might be getting a bit of a boost due to the fact that the euro has dropped quite significantly during the day and is closing at the lows of the session. This typically suggests that we are going to see a bit of a boost in the DAX, as it is so highly correlated to exports coming out of Germany. A cheaper euro makes those exports more affordable for the rest of the world. The idea is that we will see more German goods being bought, which is good for the index. However, the stimulus around the world should not be forgotten either, as the idea of stimulus will drive up the need for massive industrial exports for which Germany is so well known.

Above, I see the 14,000 level as a potential target and resistance barrier, as it has caused problems previously. If we can break above the 14,000 level, then it is likely that the market could go higher, perhaps reaching towards the 15,000 level, which is my longer-term target anyway. I do not think we will get there right away, but I think short-term pullbacks will continue to offer value, especially as we have seen the last three candlesticks find buyers at roughly 13,250. Furthermore, the fact that the candlestick closed that the very top of the range does suggest that we have a bit of follow-through, so I think that the DAX will continue to show signs of strength going forward, and I have absolutely no interest in shorting this market, not that I believe in shorting indices these days anyway. This is a very good-looking chart, and the fact that we continue to respect structure signifies that we should continue to look for short-term dips as longer-term buying opportunities. I also will be adding to a position above the 14,000 level.