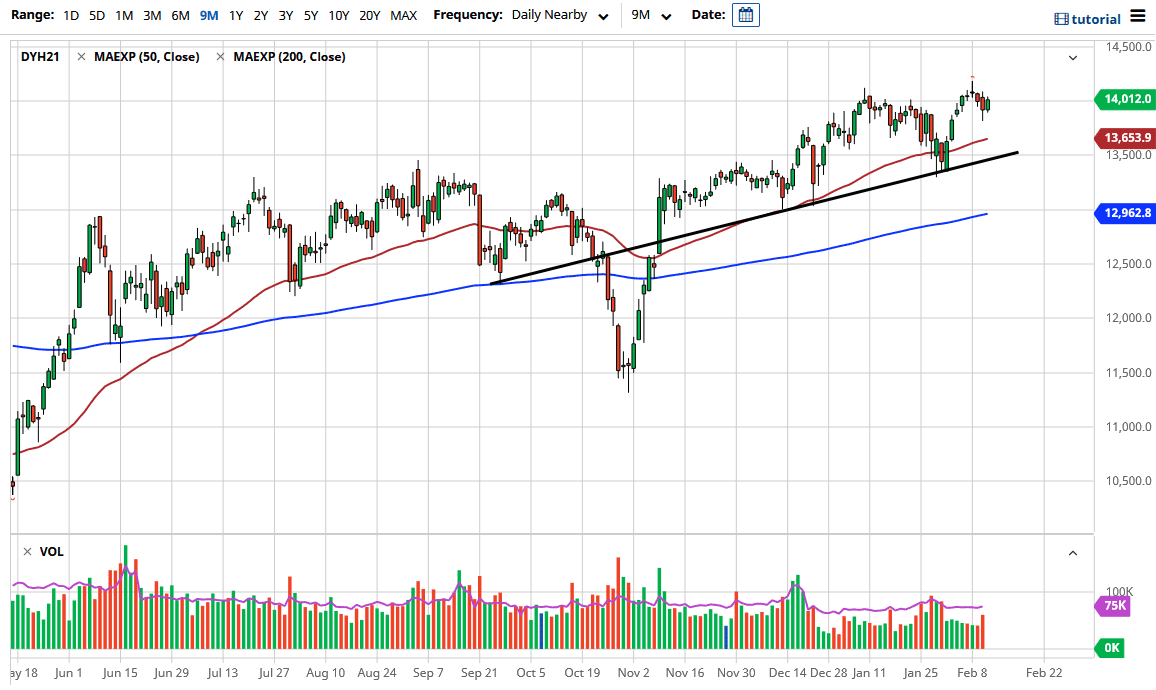

The German index rallied just a bit during the trading session on Thursday as we have recaptured the 14,000 level yet again. At this point, the market is likely to continue to see buyers underneath to continue to push the market higher, perhaps breaking out above the 15,000 level given enough time. We have been in an uptrend for a while and of course Germany is the first place that large amounts of money flow to when the investing public wants to put money to work in the EU.

Looking at the chart, we are flattening out a bit in this general vicinity, but I do think that it is only a matter of time before we get some type of catalyst to go higher. The DAX is very sensitive to exports, so it will be interesting to see whether or not there is more of the “reflation trade” out there, because that tends to favor German export companies, due to the fact that it is such a major driver of large industrial components.

The DAX of course is laden with these companies, so it makes a lot of sense that we would continue to see the DAX heavily influence. However, there is also the possibility that people are putting money towards “safer stocks” and the “safer economy” that Germany represents as opposed to the periphery of Europe, which is quite typical when people are a little bit fearful. However, they also go to the DAX first win trying to spread out on the risk curve, dipping their toe in Germany, and then eventually going to places like Spain.

The Euro remains relatively steady in a well-defined range, so that also benefits the DAX, because people feel more comfortable about the idea of the exporters being able to do a lot of steady business, as they can keep profits relatively stable when they know essentially what the costs and profits could be. In a sense, very stable currency movements are exactly what exporters need, and that does tend to favor the DAX over most other indices in general.

Ultimately, I have no interest in shorting this market, because it has been such a nice uptrend, and I think as long as we can stay above the massive uptrend line, which is currently sitting at the 13,500 level, this market is one that will continue to find plenty of buyers.