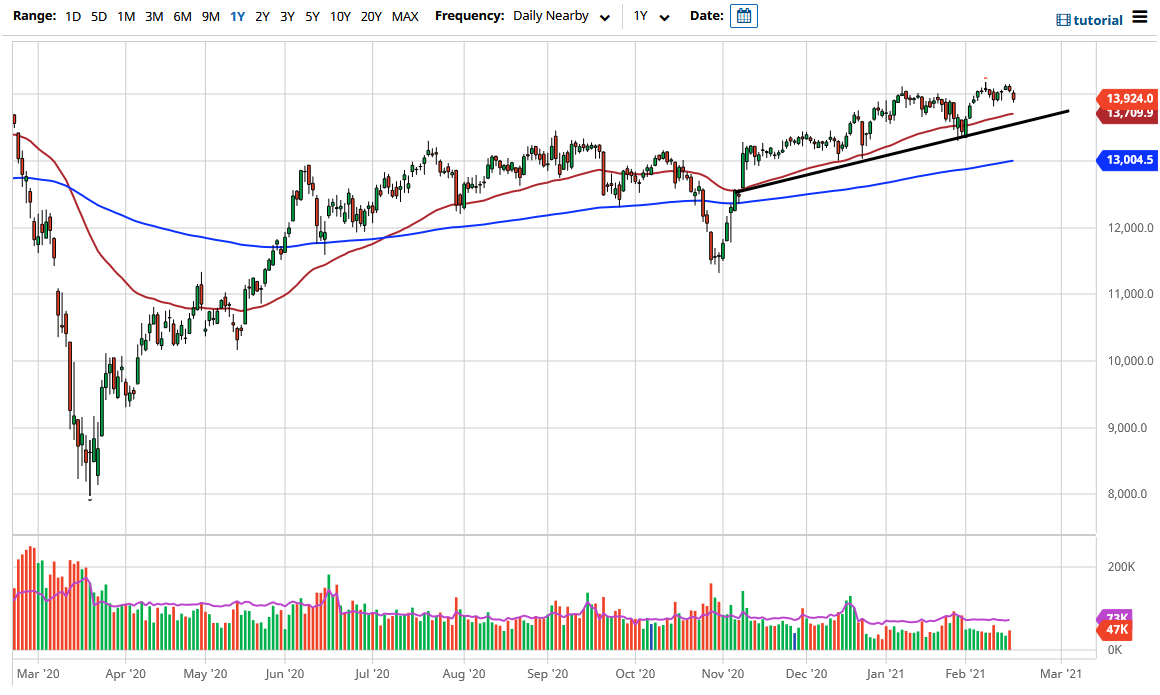

The DAX index fell just a bit during the trading session on Wednesday to break down below the 14,000 level again. I see a significant amount of support underneath, especially near the 50-day EMA at the 13,700 handle. Underneath there, the uptrend line comes into play, which will attract significant attention. I think that a pullback should be thought of as value, due to the fact that the market has been in a major uptrend for quite some time, and there is no reason to think that it is going to change anytime soon. After all, Germany is one of the first places people throw money at when it comes to the stock market, and the DAX is heavily laden with exporters.

With the euro falling, there could be a little bit of a play here if it falls significantly, as it would make German exports cheaper. In the meantime, I think one of the biggest problems that this market is going to deal with is the lockdowns in the European Union which are hampering growth. Furthermore, we have to worry about the vaccinations and whether or not they are getting distributed. At this point, it is not likely that the European Union can catch up with the US anytime soon, so that is part of what has been working against the EU in general. However, I do think that it is only a matter of time before money flows into this market due to the fact that the ECB is probably going to be flooding the market with liquidity again. After all, it is the only game in town when it comes to central banks, and the ECB has recently stated that they were very much looking at it. To the upside, I believe that the DAX will probably go looking towards the 15,000 level, but we need to get a nice impulsive green candlestick on the daily chart to really get things moving. At this juncture, I like the idea of buying the breakout above 14,000 on a daily close. Otherwise, I will look for some type of support near the 50 day-EMA/uptrend line. Nonetheless, I have no interest in trying to short this market, as it is bullish like most other stock indices in the G-10.