Bullish Case

Buy BTC/USD below 50,000.

Add a take-profit at 52,000 and a stop-loss at 48,000.

Bearish Case

Set a sell stop at 45,000 and add a take-profit at 43,000.

Add a stop-loss at 50,000.

The BTC/USD is on the verge of a bullish breakout to $50,000. The Bitcoin price is trading at $49,808, just $200 below the psychologically-important resistance level of $50,000.

Bitcoin Uptrend Continues

Bitcoin has been on a strong bullish trend in the past few months. After dropping to less than $4,000 in March last year, the currency has soared by more than 1,200%. This makes it one of the best-performing major asset in the world.

This performance has happened mostly because of the relatively weak US dollar, large appetite by institutional investors, and the growing adoption of the currency.

The greenback has dropped by more than 12% from March last year because of the policies of the Federal Reserve and the US government. The Fed has slashed interest rates to near zero and launched the biggest money-printing exercise on record. In the past 12 months, it has printed more than $3 trillion, pushing the balance sheet to more than $7 trillion.

Similarly, Congress has already launched a $4 trillion stimulus and is in the process of adding another $1.9 trillion package. If passed, some of these funds will be used to buy Bitcoin and other cryptocurrencies.

The BTC/USD is also rising because of the ongoing adoption by many companies. Last week, Tesla revealed that it had bought more than $1.5 billion worth of Bitcoin. The company will also start accepting the currency as payment. During the weekend, a unit of Morgan Stanley said that it was considering acquiring more. Further, Catherine Wood’s Ark Invest said that it was adding its stake in the GreyScale Bitcoin Trust.

BTC/USD Technical Outlook

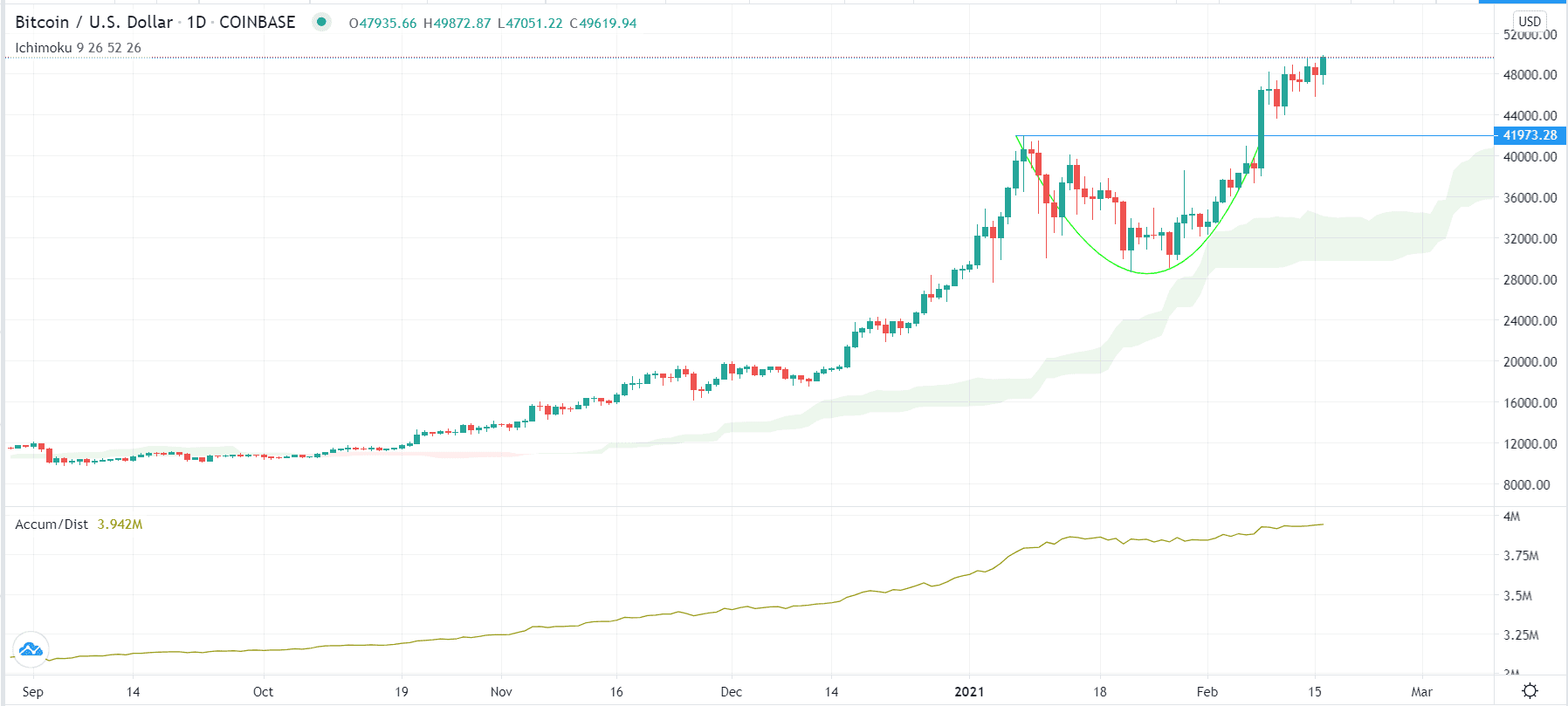

The daily chart shows that the BTC/USD has been on a strong rally in the past few months. Today, the price is attempting to move above $50,000 for the first time on record. Before the new surge, the pair had formed a cup and handle pattern. Today, it remains above the 25-day and 50-day moving averages while the accumulation and distribution indicator has continued rising. Therefore, the pair will likely continue rising as bulls target the next resistance at $50,000.