The Bitcoin markets have been back and forth during the trading session on Thursday as we may have finally ran out of momentum. This is at the end of the world, nor is it a sign that we are suddenly going to collapse, rather that I think we still have work to do to go into the next leg higher. By forming a shooting star, that of course is a negative sign that a lot of people will be paying attention to. This is not to say that you should be selling this market, rather that I think a pullback would be a little bit of a self-fulfilling prophecy.

While most people who are into Bitcoin make the mistake of ignoring the Fiat world, the reality is that it is a currency pair just like any other currency pair. You are trading Bitcoin against the US dollar, Euro, Japanese yen, or whatever. The US dollar is making a play to go stronger and has started to beat up on a lot of fiat currencies. That being the case, it does provide a little bit of an argument against Bitcoin for some traders. Furthermore, we are starting to see exhaustion due to the fact that there has been so much volatility in this market, and nothing can go straight up in the air forever.

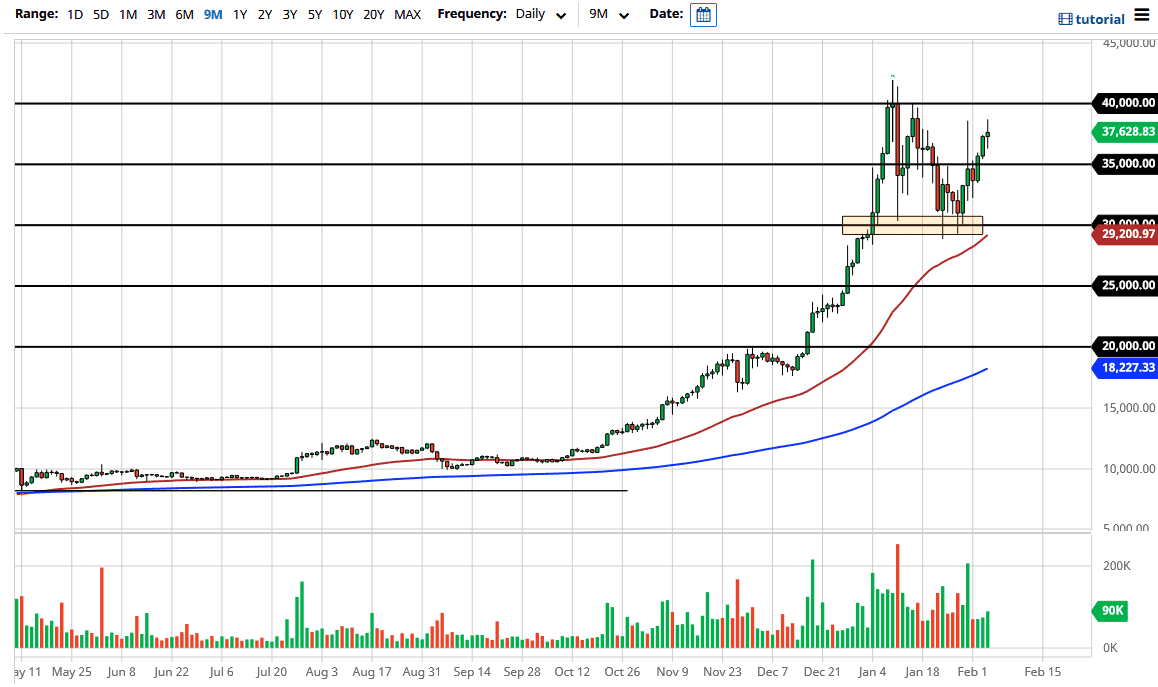

While some traders will look at this as an excellent selling opportunity, I do not necessarily think that is the case. In fact, I think what this will probably set up is a nice buying opportunity. Somewhere near the $35,000 level, there would probably be some support. Beyond that, there is even more support near the $30,000 level underneath which has already proven itself and of course features the 50 day EMA reaching towards that level as well. At this point, it is not until we break down below there that I think this market falls apart. On the other hand, if we were to break above the top of the candlestick that means we would start to threaten the $40,000 level again. If we can break above there, then it could be the next leg higher. That being said, I just do not think we have the momentum quite yet and that is not necessarily a bad thing as traders will need to work off some of the froth.