Bullish case

Buy the AUD/USD and set a take-profit at 0.7750 (Jan 27 high).

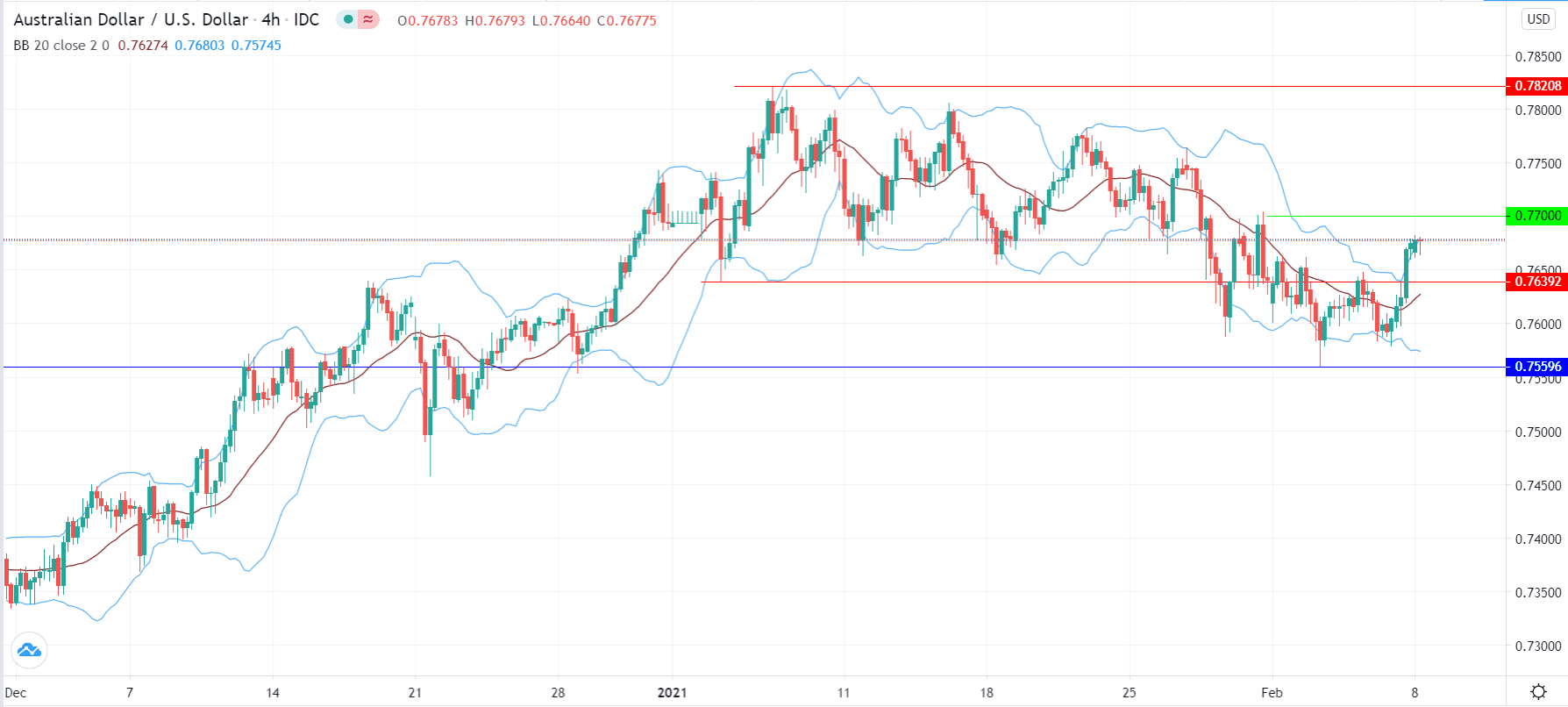

Set a stop-loss at 0.7640 (neckline of the inverse head and shoulder pattern).

Bearish case

Set a sell-stop at 0.7640 and a take-profit at 0.7580 (Friday low).

Add a take-profit at 0.7680.

The AUD/USD bounced back on Friday after the weak US employment numbers. The price rose from the Friday low of 0.7583 to a high of 0.7680, which was its highest level since January 28.

Stimulus Hopes in the US

The AUD/USD movement is mostly because of the overall weaker US dollar. The US Dollar Index has dropped from last week’s high of $91.60 to the current $91. The currency has weakened against all major currencies, including the euro, Japanese yen, and sterling.

This performance is because of the weak employment numbers from the US. The data showed that the US economy added just 40,000 jobs in January. This was lower than the median estimate of 50,000 and the ADP estimate of 140,000. The unemployment rate dropped to 6.3% while wages rose to 5.4%.

As a result, the weak numbers led to hopes of another stimulus in the United States. Indeed, the two House of Representative and Senate passed initial bills supporting Joe Biden’s $1.9 trillion stimulus package. And during the weekend, Janet Yellen, the new Treasury Secretary, said that the country would return to full employment if Congress passed the bill.

Activity in the bond market is also showing optimism of stimulus. The ten-year breakeven inflation rate has risen to the highest level since 2018. This number is the difference between long-term government bonds adjusted to inflation and those not tied to inflation.

This week, the AUD/USD price will react to the important Australian business confidence, building approvals, China inflation, and Australia’s inflation expectations. From the United States, stimulus talks will dominate the sentiment. Other important data from the US will be inflation and JOLTS job numbers.

AUD/USD Technical Outlook

Last week, the stronger dollar pushed the AUD/USD to a year-to-date low of 0.7559. It then bounced back and reached a high of 0.7677 last week after the weak US employment numbers. The price also managed to cross the important resistance level of 0.7640. On the four-hour chart, the price is at the upper side of the Bollinger Bands and is also forming a small bullish consolidation pattern.

Therefore, the pair will likely break-out higher as bulls attempt to move above 0.7700. However, a drop below 0.7640 will invalidate this thesis because it will mean that there are still sellers in the market.