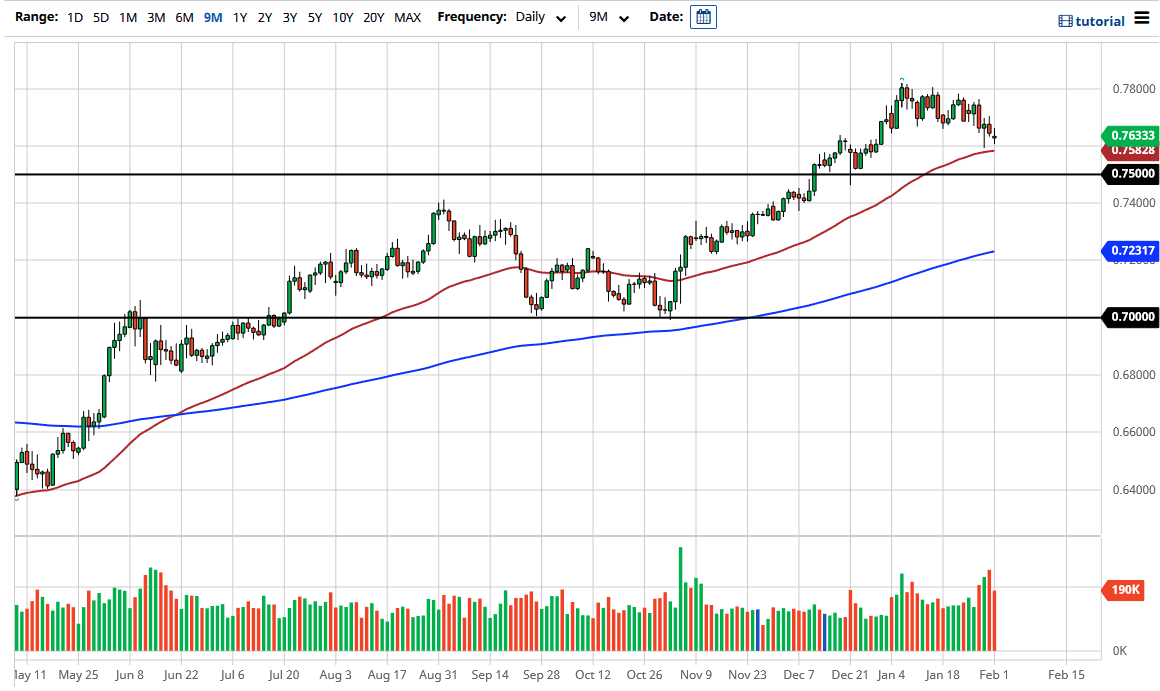

The Australian dollar fluctuated during the trading session on Friday as we continue to dance around the 0.76 handle and the 50-day EMA which is sitting just below there. The market is likely to see interest in this area, due to the fact that the reflation trade is still something that people are banking on, but at this point it is likely that the latest headlines involving stimulus and the arguments in Congress will continue to have a major effect on the Aussie dollar.

This is mainly due to the fact that the Aussie is so highly levered to commodities, and that the commodity markets are to be seen as one of the first places where a lot of money comes flying into based upon the idea that manufacturers will need more “things” such as copper and steel. Now we also would have to take a look at China, which is a huge customer of Australia when it comes to hard assets.

The market has plenty of support all the way down to the 0.75 handle, which is a large, round, psychologically significant figure. I believe that the US dollar is still going to continue to see a certain amount of people being leery of it, but the Australian dollar is a little bit overdone, so I think a pullback does make sense. If you can find value, that might be the way to go, especially if you can get a closer to the 0.75 handle. Be aware that the interest rates in the United States have been rising in the 10-year note, which is something worth paying attention to as well. But at the end of the day, I still think that we probably have more buyers than sellers in this particular currency pair. The US dollar can have vicious corrections if there is a sudden “risk off" attitude around the world, which would not be a huge surprise considering all of the shenanigans that are going on in the stock market, and now possibly the silver market, as retail traders are trying to cause major short squeeze.